होम डेकोर

Handmade Carpets Need to Tap Indian Market

Though India has been a country of carpet weaving by hand for ages, and is today a global leader for handmade carpets and rugs, it has not fully explored its own domestic market for these exquisite pieces of arts, crafts and culture. Home Fashion probed the situation and had an elaborate discussion with Mr. Kuldeep Wattal, Chairman, Carpet Export Promotion Council, to find his perspective on behalf on Indian export community.

Even as export markets for Indian handmade carpets, where India commands a whopping 37% share, continue to shrink due to weaker economic conditions in the Western countries and the demand in the Indian domestic market continues to rise, Indian rugs and carpet manufacturers have not been able to make an effective shift to this growing market. Is the Indian market opportunity for handmade carpets real? And if yes, what is holding the carpet sellers to look at this market, even as they struggle to sustain their export orders?

Prices not a deterrent

Are handmade carpets too expensive for the Indian consumers? “No, Not at all,” reacts Mr. Wattal and explains further, “India has emerged as a world leader in the hand-knotted carpet market only because of the fact that ours is the only Industry globally, which can cater to the lower, middle, higher and premium segments of consumers. Our weavers can produce carpets in economy as well as luxury range. Hence affordability of prices is not really a restricting factor in the Indian market”

It is misconception that hand-knotted carpets are very expensive and not meant for the Indian market. They can be bought starting from Rs.5,000 for a carpet in size 4 feet x 6 feet.

Of course, on the higher end, the same size rug can also be bought at prices as high as Rs. 50,000 or even Rs. 5, 00,000, depending on the yarn, fineness, and no. of knots and intricacy of designs.

Lack of Designs

Another major misconception amongst Indian consumers about handmade carpets is lack of designs and variety. Even though there has been a sea change in designs of handmade carpets over the last one decade, very little has been communicated to the consumers in India.

Today, most manufacturers have adopted to the modern design trends, leaving behind oriental and Prussian designs. Innovations have been made in use of yarns by blending different materials like viscose, wool, cotton and Jute in yarns, which allows production of contemporary, bright colours and designs which appeal to younger consumers.

This transition was very important as consumers today want their interiors to be colour and design coordinated. These days the cost has become secondary. What matters the most is how the carpet blends with the decor. Modern range of carpets made from blended fibres goes well with the modern constructions. Oriental carpets were used in oriental buildings and these days modern carpets are being used in modern flats.

Lack of Marketing

Such changes in the design capabilities of Indian carpet industry have not been communicated. Hence, the real reason for not capturing the Indian market is that the carpet industry has not promoted its products amongst Indian consumers. Information has not been disseminated to the consumers in terms of designs, product attributes and value handmade carpets bring to their homes in terms of rich Indian heritage.

Awareness level of modern handmade carpets in India is low as most consumers perceive handmade carpets as Prussian designs, oriental carpets or Kashmiri silk carpets, all of which are made with very fine knots with highest quality woollen and silk yarns. They are designed to be premium products. Today, many machine-made carpet makers copy these designs as cheap imitations and also promise low maintenance, giving severe and unfair competition to the original Indian products.

Role of Indian Retailers

Indian retailers selling carpets are doing well, but they do not wish to share their success with others. Nearly 1,000 retailers in India sell carpets. But even retailers aren’t aware about the latest developments in this sector and need to be educated. Some leading specialty stores like Jagdish Stores who have focussed on this category are doing well. They carry the entire range and wide price points to cater to all segments.

Machine-made carpets better?

There is a popular perception in India that machine-made carpets are better than the handmade ones. How far is it true? “The only reason why machine made carpets are in demand is because they have been aggressively promoted here. Therefore, marketing is the key issue. Given a choice, the consumer would prefer to have hand-knotted carpet which is hundred times better than a machine made carpet,” insists Mr. Wattal.

“Raw materials used in machine made carpets like polyester and polypropylene are not consumer friendly. On the other hand, natural fibers like wool and silk used in handmade carpets are good for health and environment. They are also better in comfort and performance in day to day usage. Machine-made carpets do not last long and are difficult to be washed.”

“If awareness is created amongst Indian consumers on all these comparative aspects, I am sure, they would prefer hand-knotted carpets, over machine-made ones,” emphasizes Kuldeep Wattal.

Need for market focus

“CEPC certainly realises that India’s domestic market offers a huge opportunity, even in the global context. When the whole world is looking at India as one of the most important emerging markets for its products, there is no reason, why we should ignore it. But, for years, the Indian carpet industry has been very much focused on exports. We have been trying to develop the Indian market for some time now through trade shows like HGH India and other focussed efforts. Many exporters are trying to develop a domestic market on their own as well”, says Mr. Kuldeep Wattal, Chairman Carpet Export Promotion Council.

Indian carpet manufacturers need to have a much deeper penetration in the domestic market. We want more events like HGH India for carpet industry with a focus on Indian domestic market to come up in the future, where our participation should be of the size of events like Domotex in Hanover.

Modern Floor Coverings: Beginning of a new era in India

When it comes to use of floor coverings, India has been completely defying the global trends. “For us Indians, traditionally, the most preferred floor covering has been various forms of stones and marble, which till today account for 80% of the country’s floor coverings consumption. This percentage in countries like USA, Europe and even China is between 30-40%,” says Roshan, Director, Ego Flooring Pvt Ltd.

When it comes to use of floor coverings, India has been completely defying the global trends. “For us Indians, traditionally, the most preferred floor covering has been various forms of stones and marble, which till today account for 80% of the country’s floor coverings consumption. This percentage in countries like USA, Europe and even China is between 30-40%,” says Roshan, Director, Ego Flooring Pvt Ltd.

Why conventional stone is so popular in a country, which makes the most exquisite and luxurious handmade wool and silk carpets in the world, which are full of softness and character. Not only that, these rugs are sought by buyers across the globe, with India commanding a lion’s share of 38% in the world market, clearly indicating, volume and scale of production. Then why don’t Indians themselves use these lovely rugs in their own homes?

It’s certainly not because of affordability, knowledge or choice of Indians. They want easy maintenance, and cool feeling being a warm climate country, which is offered by most forms of marbles and stones. Handmade woollen and silk rugs are simply unaffordable in terms of prices for most Indians, too warm for most parts of India’s climate and are difficult to maintain in the country’s dusty environment. And very few know about more options in floor coverings beyond these two categories.

Modern floor coverings

It seems that the consumers here are simply not exposed enough to the plethora of modern floor coverings to which the world has been changing over to during the last three to four decades. Lack of knowledge, lack of understanding, not enough push by the manufacturers and brands are some of the reasons that Indians continue to live with their traditional floor covering solutions.

So what are the modern options in floor coverings? Several, to answer the question straight. From wooden flooring to vinyl to astro turf to a variety of synthetic solutions for both indoor and outdoor applications. Further each one of these main categories have several sub-categories and infinite design, style, price and technical options for various end uses like residential, institutional, outdoor, sports and so on.

Home Fashion spoke to some key industry players in these categories to assess the current market scenario in India.

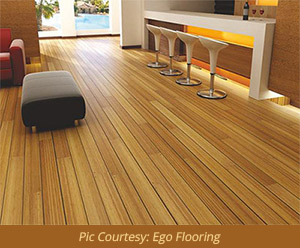

Roshan Bisani, Director, Ego Floor

Roshan Bisani, Director, Ego Floor

Ego Floor is a10 year old company, pioneering in India the sales of wooden floor coverings, completely under its own brand “Ego”.

Though the Indian market for modern wooden floor coverings is in existence for over 25 years, it was very small and demand has been from niche segments. Its only in the last 10 years, the market has started unfolding in true sense.

Key Categories in wooden floorings are Laminated flooring, engineered flooring, solid wood, outdoor and sports flooring.

Currently, the Indian market size for wooden flooring would in the range of Rs. 1000 to 1500 crore, of which only about 25% is catered by 12-15 branded and organised sector players. Of this Indian brands are not more than 2 or 3, Ego being one of them.

We also distribute in India some international brands like Quick Step from Belgium; Pergo from Sweden and Kronotex from Germany. Kronotex is world’s number one brand with a market share of about 20% in India.

We also distribute in India some international brands like Quick Step from Belgium; Pergo from Sweden and Kronotex from Germany. Kronotex is world’s number one brand with a market share of about 20% in India.

Out of the total floor covering market in India, wooden floors account for only 2-3%, synthetic and vinyl for 7-8%, carpets for another 8-10% and stones and marbles for 80%.

Sunil Parekh, Director, A to Z

Sunil Parekh, Director, A to Z

In India the demand for modern floor covering is for Polypropylene because people are influenced by the looks of the product. It is also eco-friendly and recyclable. The choice is more towards carpet tiles for office and corporate areas, vinyl flooring for hospitals and nylon flooring for general use. Major sub categories are carpet, carpet tiles, PEC flooring and vinyl.

Current size of the Indian market is about Rs. 400-500 crore, which is annually growing by 40-50%. Key players in this business currently are importers as very little is produced in India due to lack of technology, investment and market size.

A to Z markets its own brand ‘walk-on’ in India. Walk-on floor covering mainly manufactures wooden floor covering on planks and tiles used for both interiors and exteriors.

The products manufactured are sold by architect, dealers, distribution through online presentations from architects.

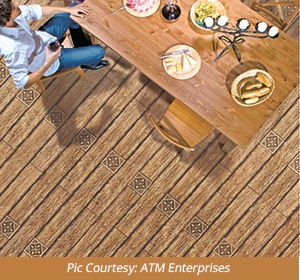

Vatsal Bajoria, ATM Enterprises

Vatsal Bajoria, ATM Enterprises

Key products available in India in modern home flooring are the wooden flooring and PVC or Poly Vinyl Chloride Flooring, which are considered the most important among the other categories like Polypropylene and grass flooring.

Though tiles and marble are used extensively in India, with changing trend and lifestyle, the demand for wooden and vinyl flooring is increasing.

Wooden flooring is further divided into 3 categories which are: laminated flooring, engineered flooring, and solid wood flooring. Similarly, vinyl floorings are offered multiple varieties like tiles, carpets, strips flat planks etc.

While wooden flooring is used in offices, for homes primarily synthetic carpets, nylon carpets and cheaper Polypropylene flooring & nylon are in use.

Among all the players of modern floor coverings present in India, some well European brands include Armstrong, Pergo and Kronotex.

Indian market for modern floor covering is very good and is growing by about 10-15% per annum, including in tier 2 and tier 3 cities.

Manish Singhvi, Director, Spaarsh (VIVA Surfaces)

Manish Singhvi, Director, Spaarsh (VIVA Surfaces)

The demand for wooden flooring is increasing year on year and it occupies 25-30% share of the entire modern floor covering market in India.

Size of the Interior wooden flooring in India is around Rs. 200-300 crores.

The products are usually imported from Europe, Korea & China. Keeping the demand in mind, wooden flooring further has been created in varieties such as a laminated, engineered and solid wood bamboo. These three have different compositions with different usages in the industry.

In laminated flooring, High Densified Fibre (HDF) backing is done by pressing a decorative paper along with the fibre on HDF board. HDF board is a particle board with different sizes of 8mm, 10mm and 12mm. Engineered flooring is made upon Plywood or a Pine wood with a layer of actual wood on top of size12mm. Bamboo Flooring is a solid actual real wood flooring in which actual bamboo is composed and processed.

These floorings come in planks and in tiles shape which has an interlocking system and needs a professional to install in the required spaces.

Market growth for wooden flooring is only 10% as Indian climate is mostly hot and humid, where people prefer mostly marble flooring to keep the interior cold. Besides, marble flooring is readily and conveniently available to the consumers.

Vinod Hemnani, Vice President, Symphony International

Vinod Hemnani, Vice President, Symphony International

Annual growth rate of 20-25%. Main stores are in Mumbai, Hyderabad and Bangalore. More stores are expected to be launched in Kolkata, Delhi and Ahmedabad over the next 4-5 years. Distribution is done through their own dealer network besides their own shops. Direct contact with architects is maintained as 90% of wooden flooring business comes through recommendation by architects.

Retail prices for low-end wooden flooring starts from Rs.80 Square foot and goes up to Rs. 3000 per square foot. Currently, the Indian market demand consists of about 40-50% for low-end, 30-35% for mid-range and only about 12-15% for the premium range.

Products under Symphony International are 100% imported as the raw material like oak, used specially for flooring is not readily available in India for manufacturing, so it has to be imported.

Overall market growth for wooden floor covering in India is between 25-35%, which is likely to grow at a faster pace in the future as consumers get exposed to the benefits of wooden flooring over marble and stone flooring, in terms of temperature control and friction on the surface. Besides, there are health benefits. For example, wooden staircase is much more comfortable to the knees, it is less tiring as it provides more flexibility to the body due to a cushioning effect which stones do not have.

Wallpapers: Exponentially growing demand

With just 7 or 8 textures to offer and high dependence on attributes like durability, lustre, weather proofing, the conventional wall paint industry is rapidly losing out to wallpapers, a wholly new concept in wall décor and wall finishes. Although wallpapers were invented centuries back, their modern version has evolved only after World War II.

With just 7 or 8 textures to offer and high dependence on attributes like durability, lustre, weather proofing, the conventional wall paint industry is rapidly losing out to wallpapers, a wholly new concept in wall décor and wall finishes. Although wallpapers were invented centuries back, their modern version has evolved only after World War II.

Let’s take a quick look at global evolution of wallpaper as we see it today, before we take a look at the current Indian scenario.

Evolution of Wallpapers

Evolution of Wallpapers

Though China and Japan are credited with invention of paper in general, thousands of years back, Jean-Michel Papillon, a French engraver is considered the inventor of modern wallpaper. He started making block designs in matching, continuous patterns in 1675, and wallpaper as we know it today was on its way. The oldest available example of flocked wallpaper is from Worcester, UK, which was created in 1680. Plunket Fleeson brought wallpapers to America in 1739, when he started printing them in Philadelphia. In 1778, Louis XVI issued a decree that required the length of a wallpaper roll to be about 34 feet.

Frenchmen, Christophe-Philippe Oberkampf invented first wallpaper printing machine in 1785. Nicholas Louis Robert, also from France, invented method of making continuous roll of wallpaper around the same time. The English invented new manufacturing methods in 18th century in London, which became global rage. In 1888, Ferdinand Sichel developed the first ready-to-use wallpaper paste. Wallpaper pasting machines first appeared around the turn of the 20th century.

The Victorian Era was a grand time for wallpaper featuring over embellished designs featuring somber colors. 1920s was known as the Golden Age of Wallpaper. Some 400 million rolls were sold during that period.

Plastic resins were introduced after World War II. They offered stain resistance, washability, durability and strength and truly revolutionized the wallpaper industry. Recent advances in digital, photo, and printing technologies have allowed modern printing facilities to replicate historic papers and other digital media on a variety of substrates.

Wallpapers continue their appeal to human fantasies for wall décor. Today, new inventions have become an ongoing process in this field and wallpaper designs have established an identity of their own.

Wallpapers continue their appeal to human fantasies for wall décor. Today, new inventions have become an ongoing process in this field and wallpaper designs have established an identity of their own.

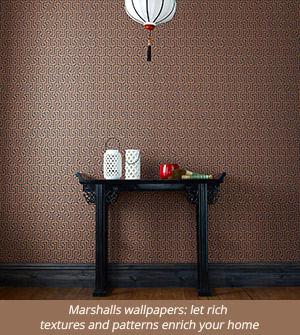

“Each manufacturer has their own speciality and depending on their focus they make their creations accordingly. Today’s wallpaper techniques include blown vinyl, solid vinyl, deep embossed vinyl, surface printed non wovens, natural wallcoverings like silk, jute, mica chips etc.,” informs Karan Sharma, Director, Marshalls Wallpapers, Mumbai, one of the oldest and today a name synonymous with wallpapers in India.

Indian scenario

Indian scenario

“It is very difficult to estimate wallpaper market as there is no proper market data available. But as per my personal estimate it should be around a 200 crore industry which 7-8 years back was only around 25-30 crore. Thus the growth has been excellent,” says Karan Sharma.

Although no official research figures are available, the size of overall wall finish market in India is estimated to be over Rs. 25,000 crore, or so, according to industry sources. Of this about 50% to 55% is for interior wall finishes like paints, which amounts to about Rs. 13,000 crore. Wallpapers today account for only 3 to 4% of total interior wall finishes market, which should value around Rs. 500 crore. “It is very difficult to estimate wallpaper market as there is no proper market data available. But as per my personal estimate it should be around a 200 crore industry which 7-8 years back was only around 25-30 crore. Thus the growth has been excellent,” says Karan Sharma, Director, Marshalls Wallpapers, one of the oldest and today a name synonymous with wallpapers in India. Thus, the opinions on market size amongst industry players vary between Rs. 200 Crore to Rs. 1,000 crore.

And what are the most popular price points in India? About 70% of India’s wallpaper sales come in the retail price band of Rs. 60 to Rs. 150 per square foot, according to industry sources. Remaining comes from higher price segments between Rs. 150 to Rs. 1,800 or even higher, per square foot. Then why can one see wallpapers priced as low as Rs. 10 or 20 per square foot in India? “Anything selling below Rs. 60 is basically, either defective products, dead stocks or outdated designs,” explains Chandresh Parekh, Director, Wall King, Hyderabad.

And what are the most popular price points in India? About 70% of India’s wallpaper sales come in the retail price band of Rs. 60 to Rs. 150 per square foot, according to industry sources. Remaining comes from higher price segments between Rs. 150 to Rs. 1,800 or even higher, per square foot. Then why can one see wallpapers priced as low as Rs. 10 or 20 per square foot in India? “Anything selling below Rs. 60 is basically, either defective products, dead stocks or outdated designs,” explains Chandresh Parekh, Director, Wall King, Hyderabad.

In absence of any reliable data or research, annual market growth estimates for Indian market vary amongst industry players between 15% on the lowest to 50% on the higher side. But the growth in higher-end market seems to be certainly much better. “We have been growing by 30 to 40% per annum in recent years,” said Rohit Gupta of Elementto, a leading Mumbai based player, which deals only in premium & luxury segments. Marshalls, the market leader also reports an average of 30% annual growth.Chandresh Parekh, Director, Wall King, is even more bullish about market growth in India. “I feel the Indian wall paper market will grow by over 100% every year. We ourselves are experiencing an average growth between 50 to 60% per annum.”

With such high growth, what direction is the market taking? “Indian wallpaper market is very unorganised. There is a big influx of cheap Chinese and Korean wallpapers. Organised sector companies have started entering this field in India only in the last couple of years, which should certainly help the industry grow. For a long time, Marshalls has been the only organised player,” says Karan Sharma, Director, Marshalls Wallpaper.

With such high growth, what direction is the market taking? “Indian wallpaper market is very unorganised. There is a big influx of cheap Chinese and Korean wallpapers. Organised sector companies have started entering this field in India only in the last couple of years, which should certainly help the industry grow. For a long time, Marshalls has been the only organised player,” says Karan Sharma, Director, Marshalls Wallpaper.

Tamim Mandsaurwala, Director, Excel Wallpapers, another leading player based in Kolkata has similar, but slightly different opinion to offer. He says, “Since Indian market is really not organised it is difficult to define its size. But I believe it should be currently valued between Rs. 600 to 1000 crores. Indian wallpaper market is growing at least between 25 to 30% per annum. We expect this growth to continue. Market is still at a nascent stage, but has a very high growth potential.Wallpaper for sure is becoming an important product in wall finish segment. That is why leading paint companies are also venturing into wallpapers now a days.” Another key reason for players in paint industry entering wallpaper field is that besides a large market opportunity, they see a big synergy between wallpapers and paints business.He feels that the Indian Government’s focus on infrastructure development and smart cities will lead to tremendous growth in wallpaper demand in coming years.

Karan Sharma of Marshalls felt that the business was tough last year due to the recessionary trends and real estate market being in a limbo, but agrees with Tamim, “If the economy improves, then this industry will zoom up further and I expect it to grow by 30-50% in the next 2 years.”

Karan Sharma of Marshalls felt that the business was tough last year due to the recessionary trends and real estate market being in a limbo, but agrees with Tamim, “If the economy improves, then this industry will zoom up further and I expect it to grow by 30-50% in the next 2 years.”

Vivek Khandelwal, Director, F & F, another well-established, leading Delhi based importer too pegs Indian market growth at 25% per annum. He feels that there is still a room for high growth in this segment because the paint industry is stagnant in terms of innovations.”

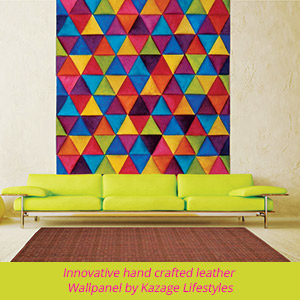

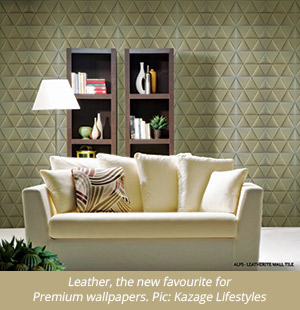

Not only popular varieties, demand in India for specialised, niche wallpapers too is growing. “We deal in natural and truly leather like category of wallpapers only. Since our products are different from the ones available in the market, discerning consumers are increasingly preferring them over the regular ones,” says Gaurav Bhatia, Marketing Manager, Kazage Lifestyle, which deals only in such niche items.

“70% of Europe, both west and east, are today wallpaper markets. 99% of wall finishes in Developed Asian countries like Japan, Korea and Taiwan are wallpapers. China, which like India today, had just 2% share of wallpapers in its overall wall finishing market 30 years back. Today, wallpapers’ share in China has risen to 30%. This is a massive growth of 15 times in 30 years. India is likely to follow,” asserts Karan Sharma

Import Scenario

Import Scenario

China is a major source for mass market, low quality wallpapers. Korea offers medium to high qualities and premium products come from USA, Germany, Italy, Belgium, France, UK and other European countries. Quantity wise China and Korea are the biggest suppliers of wallpapers to India. But innovations, new concepts and trends come from Europe.

“You can get good quality products in both China and Korea too. But it all depends on the price one is willing to pay. If you are ready to pay a higher price, you can get very good quality goods even from these countries. It is our responsibility as an importer to ensure that right quality of wallpaper is supplied to the consumer,” advocates Karan Sharma.

Each brand has its style which emerges from the country of origin. Italian products are totally different German ones. Similarly, American wallpapers are distinguished from Korea in terms of quality or manufacturing technique. For example, USA wallpapers are pure paper products whereas German are blown vinyl based and Italy makes solid vinyl products.

Chinese products retail between Rs. 10 to Rs. 80 per square foot, Korean between Rs. 25 to Rs. 300 and European wallpapers sell between Rs. 90 to Rs.1500 per square foot. Current import duty in India is 30%.

According to industry sources, in India’s overall wallpaper imports, China has a share of 40%, Korea 20% Europe 25%, USA 10% and others 5% in India’s wallpaper imports. And what is the average size of operations for an Indian wallpaper marketer? Even today, the biggest players, which you can count on fingers, would not have achieved individual annual turnovers of Rs. 20 to 30 crore. Besides, about 30 to 35 players do a sales of around Rs. 10 crore per annum. Rest of the market is catered by very small, marginal, regional players. Vivek Khandelwal of F&F puts the number of wallpaper importers at 100, of which 12-15 are well- organized according to him.

Wallpapers are of different types in terms of materials, technologies and backings used. While Vinyl coated wallpapers are considered high quality, choices of backing and type of wallpapers is usually made by the user based on budget, purpose and durability desired.

Vinyl: Vinyl and PVC (Poly Vinyl Chloride) coating on wallpapers mean the same. It is the most durable and widely used form of wallpapers. They are 100% washable, colourfast and fire retardant. Within PVC also, there are varieties like solid vinyl, blown vinyl, embossed vinyl etc.

Pure Paper: Pure paper wallpapers are qualitatively the best and mostly in USA. They have a very rich feel in terms of designs and colours, but are three times more expensive than other varieties. Hence, only discerning buyers seeking high quality products go for them. Pure paper wall papers are usually coated with acrylic instead of PVC, giving a far superior feel over the latter.

Fabric Front: Fabric front wallcoverings have limited usage and used more in exclusive areas where movement is less. This is because fabric wallpapers are not washable, colourfast or fire retardant.

Backings: The backing of the wallpaper can be of 3 types. First, the normal paper which is an old concept, but has few inherent issues. Most of the Chinese and Korean wallpapers are still made predominantly in this type of backing to reduce cost. Second type and the latest backing is that of non-woven fabrics, which is amazing quality and makes the process of installation and removal very easy. The third type is fabric backing, which is generally used in project wallpapers where impact resistance is a key factor in decision making of choice of wallpaper. Examples of such high traffic areas are hotels, corporate offices etc.

Making in India

Making in India

And why are quality wallpapers still not produced in India? Reasons are obvious. One, the market for quality wallpapers, though evolving rapidly, is still at a nascent stage. Current volumes do not justify high investments in manufacturing. Besides, technologies required are also not available indigenously. Asked, if the importers would consider manufacturing in India in the near future, “we may think about it after 4 to 5 year,” comes the answer from Rohit Gupta of Elementto. “Everything at the moment is imported. I believe it is just a matter of time. As soon as we can sell sufficient volumes, they will get manufactured in India,” supports Tamim Mandsaurwala.

“Except for the digital wallcoverings which we manufacture ourselves, the vinyl wallcoverings are all imported by us predominantly from Europe and USA. Manufacturing vinyl wallpapers makes sense only if the volumes are very high, which is not the case in India currently. In fact, we ourselves used to manufacture wallpaper in India from 1985 to 2008, but shut down the facilities in favour of imports,” reveals Karan Sharma of Marshalls.

Given Marshalls’ experience of nearly two decades, manufacturing wallpapers in India is a very tedious and difficult process due to several reasons like raw materials, design, technology, infrastructure and skilled labour. “Unless the ground reality changes for small scale manufacturers, it will always be difficult to produce in India. Moreover, the market size here has to grow to at least Rs. 500 crore to make local production viable,” insists Karan Sharma.

“It is simply not practical to produce wallpapers in India at the moment,” emphasizes Chandresh Parekh of Wall King. “Every brand has to launch at least 4 to 5 new collections every month in form of catalogues to stay in the market. That would make about 50 to 60 collections in a year. Every design, within each collection must be manufactured and stocked in sufficient quantity over a period of few years, since these catalogues remain in circulation all over the country and dealers ask for repeat quantities. This requires every design in the catalogue to be produced in sufficient quantity and stocked over years, which is not viable in India. Hence, depending on large global producers is the only option,” Mr. Parekh concludes.

Quality of Indian wallpapersis much inferior to their international counterparts, hence hardly 2-3% of the country’s total wallpaper consumption is produced domestically. Indian products have not gained much consumer acceptance even within the country, simply on quality grounds,” shares Manish Singhvi, Director, Spaarsh India Pvt. Ltd. and adds further, “though it may be technically possible to produce the premium range in India, the cost of production for the same is very high, making it uncompetitive.”

Wallpapers versus paints

Wallpapers versus paints

Do wallpapers really compete with conventional wall paints? “Not really,” asserts Rohit Gupta, and clarifies further, “While textures in interior wall paints are limited to 7 or 8, wallpapers offer thousands of innovative designs and textures in categories like vinyl, non-woven, paper backed, fabric backed, natural wallpaper and silk bonded.” Besides, while paints generally cost much lesser and are used as a base finish for the walls; wallpapers are relatively more expensive and have a high wall decoration element. More differences are cited by Tamim of Excel. “Wallpaper are faster to install, are odourless and do not create mess. Wallpapers add character to the wall they are used on. These days, one often sees a combination of paints and wall papers to create unique interior effects.

Karan Sharma of Marshalls adds more reasons for wallpapers scoring over paints. “Wallpapers from Marshalls are 100% washable colourfast and fire retardant. The range of designs and textures and concepts offered by our wallpapers are incomparable with the variety in paint…wallpaper is a machine made product and hence the consistency of texture design and colour is supreme as against paint which is applied manually on the wall to create any texture or even make a dark shade,” he emphasizes

Karan Sharma of Marshalls adds more reasons for wallpapers scoring over paints. “Wallpapers from Marshalls are 100% washable colourfast and fire retardant. The range of designs and textures and concepts offered by our wallpapers are incomparable with the variety in paint…wallpaper is a machine made product and hence the consistency of texture design and colour is supreme as against paint which is applied manually on the wall to create any texture or even make a dark shade,” he emphasizes

He adds further, “Paint also tends to lose its shine and strength in colour over 2-3 years whereas there wallpaper colours can last easily 8-10 years without any fading.The only disadvantage in wallpaper could be quality of the product…if the quality of the wallpaper is good there is no reason why it can’t adorn the walls for 8-10 years. Hence, one needs to take care of the same while choosing the vendor for wallpaper.”

He adds further, “Paint also tends to lose its shine and strength in colour over 2-3 years whereas there wallpaper colours can last easily 8-10 years without any fading.The only disadvantage in wallpaper could be quality of the product…if the quality of the wallpaper is good there is no reason why it can’t adorn the walls for 8-10 years. Hence, one needs to take care of the same while choosing the vendor for wallpaper.”

In the developed countries, government regulations for hotel industry and health & environment consciousness amongst consumers too are driving the trend in favour of wallpapers. Use of wallpapers is being increasingly preferred for both residences and offices, as paints cause odour, emit fumes, cause skin allergies at times and take time to apply. Some of the paints are also inflammable.

Blinds: Emergence of a new category

Blinds is a new and emerging category, so much so that even correct assessment of its market size in India is not possible at the stage – estimates vary from Rs.200 crore to Rs,2000 crore when hardly 1% of the market potential has been tapped till date. Huge opportunity lies ahead…

Blinds is a new and emerging category, so much so that even correct assessment of its market size in India is not possible at the stage – estimates vary from Rs.200 crore to Rs,2000 crore when hardly 1% of the market potential has been tapped till date. Huge opportunity lies ahead…

Blinds is a concept that is relatively new to India and going by the potential and recent growth graphs for this sector, the players are few. While some industry experts see window blinds as a substitute for curtains or window films, other feel it is an addition, a new category in window dressing that is trendy, and becoming fashionable by the day. The first window blinds in India were introduced about 40 years back by brands like Vista and Mac. It was the usual Venetian blinds, which are now out of fashion.

Fabric blinds came to India 20 years back. Mac was the dominant player then. Hunter Douglas, the famous European brand entered Indian market with similar products 5 years later. The second generation blinds came in India 10-12 years back – the Roller and Roman blinds – following large scale demand from IT companies who were environment conscious and wanted to save on energy with blinds. These could regulate sunlight as per the requirement.

Market size

Market size

It is estimated that about 3 years back the Indian market for blinds was worth over Rs.200-300 crore and conservatively speaking, the growth in residential has been 20-25% per annum while in commercial the pace of growth was 10%. The total blind market as of 2015 is therefore estimated at about Rs.500 crore. And the market will certainly grow rapidly from here.

Viewed against the potential, it is estimated that blinds have reached less than 1% of the windows in India,. “But I am sure it will grow very fast because in USA too, it was a similar situation 10 years back.Today 50% of the windows have curtain and remaining 50% have the blinds. So, after 8-10 years, in India too it should be 50-50,” says Ashok Paun, Managing Director of Accumax Interiors (Marvel).

Seen I this context, “the Indian market for blinds should be around Rs.5000 crore over the next 5 years and if the growth is 25% this year it will be 30% next year, 35% thereafter, and so on,” according to Hemant Bhide of Louver line.

Share of international brands like Forest and Hunter Douglas put together is said to be less than 10% of the Indian market. The global market share of these brands is reported to be Rs.6,000 crore for Hunter Douglas alone of which India contributes very little yet, according to market watchers.

“Earlier there were only three type of blinds Roller, Vertical and Venetian, which was generally (wooden. They were easy to make. Share of business of these 3 blinds currently is about 60-70% but it is reducing day by day,” explains Ashok Paun, whose brand Marvel has been constantly innovating in this category. Now there are 12 types of blinds, these are technically sophisticated so can’t be as easily replicated. The new variations include Shutters, Panel Blinds, Roman Blinds, Sheer Horizon Blinds, Duplex Blinds, and so on.

“Even now in India there is little awareness of blinds. One reason is, companies that initially introduced this product in India’s residential sector fixed prohibitive prices due to which the product got completely neglected in the residential market,” says Hemant Bhide.

Market share & positioning

Market share & positioning

While some industry experts place the share of branded and unbranded at 50% – 50% each, Hemant prefers to divide the market between national branded players, global branded players and pan India unbranded suppliers. “I think about 31% of the market is with national brands, about 17% with international brands and remaining 52-53% is catered to by unbranded market,” he adds.

Asked about market share of his brand Marvel, Ashok says “Marvel is a market leader in India with 40% share in the branded segment. In the South we are No.1 and in west we are at No. 2, the reason being that Marvel is very innovative.We innovate and update regularly,” he asserts.

Similarly, speaking of TOSO, the famous Japanese brand of blinds which he represents solely in India, Adarsh Todi, Managing Director, NBT Exports Pvt. Ltd. says “International quality in blinds is far superior to their Indian counterparts at this stage. For example you can even lift a Toso blind with 2 fingers whereas in normal blinds you have to use more strength to lift. Toso requires no maintenance for years, no tilting or anything like that. Quality of the material is superior too. It uses original American fabric, not look-alike Chinese. In India the year-on-year growth for us is around 20%.”

Forest, another leading international player from Netherland player, entered the Indian market 10 years ago together in collaboration with A to Z Lifestyle. “About 70% of our worldwide export is going into the contract or hotel business,” says Hans van Aken of Forest. “We are not selling on price but on quality and experience. The Indian market is huge and has enormous potential in both residential and contract market. The designers and architects are better aware of the needed quality. We doubled our turnover in India nearly every 2 years. At the moment we are producing from Europe.”

Usage & comparison

Growth in the demand for blinds in India was triggered primarily by the IT Companies some 10-15 years back. They required huge complexes and needed to save on energy usage by regulating the flow of sunlight in a most optimum way. Blinds were the best and most effective option. Majority application in IT companies is of Roller blinds because it is very easy system to restore.

In the institutional or commercial sector the two popular applications are the Vertical blind and the Roller blinds. Residential sector has started picking up hardly 3-4 years back.

It is difficult to say if blinds are proving a substitute to curtains or to films on window glasses or it is a new category altogether. “To a certain extent they are competing with curtains, but only in the residential sector,” says Adarsh Todi: “They are definitely displacing window Films from both institutional and residential sectors, because the films are proving unhygienic and undesirable. In fact we are trying to increase public awareness against usage of films.”

“Curtains can be replaced with better and sophisticated curtains,” says Hemant Bhide: “It is only the shear category of curtains that will be replaced by blinds.”

Ashok Paun says in some varieties blinds are cheaper then curtain. “Latest innovation in blinds look much like curtain but function like blinds. The printed blinds look same as curtain. Blinds can be customised, the way you want it. Marvel commits dispatch within 48 hours and installation within 4-5 days” he explains.

Blinds basically have 2 major components, one is the mechanism and second is the fabric. Both are equally important. Today, the price of blinds vary from Rs.100 to Rs.1000 per sq. foot and major cost component in the blinds is it’s fabric. Only about 20-40% of the cost is of mechanical components and 80-60% goes in fabric.

“Average price of Forest blinds are 25-30% higher than the local ones because of the import duties, which stand at 28% whereas in domestic production excise duty is only 12-14%,” says Sunil Parekh of A to Z, the sole distributor for Forest in India.

Most of the blinds are imported from Europe or China. In the branded segment even the binds fabric is imported, about 90% of it. It is the reverse in the unbranded segment. Some companies have recently been set up in India to produce the fabric and components.

Market trend

Market trend

“I have travelled worldwide for this product and observed that usage of blinds in is Australia is as high as 90%, in US and UK it is 70% and in India it is not even 1%, “says Ashok Paun: “so much so, new blinds are technically very convenient for usage in home and offices. The role is now moving from Sun protection to home décor with fabric matching the overall interiors.”

Speaking of the trend in Indian blinds market, Hemant Bhide says “Vertical blinds market are down as far as residential sector is concerned. Approximately 50% market is with un-authorized players and so the prices will have to remain low for the common variants. These products look exactly same as the branded ones but the problem is in their operating system which very soon gives away.”

“Up to 2010-11 we were zero in the retail segment and 100% business was from IT. Today within 4 years we have already done the IT but in overall scenario 60% revenue comes from IT and 40% from retail. Branding is going to be important in coming years.”

“Forest and Hunter Douglas have a joint venture and together they sell in 80 countries,” says Sunil Parekh of Forest: “in the unbranded market the best product gets copied the most, and that is our brand Forest. Still we have 60-65% share of the institutional market. Our business in the retail market is also doubling every year.”

Overall the market is moving towards the quality branded blinds and there is huge margin in the business. Even if each of the branded players manage to get 1% of the Indian market share, it will be a great business proposition.

Handmade Carpets

It is time carpet industry tries to develop the domestic market as well. “Keeping in view substantial growth of middle class population in India, and knowing fairly well about their aspiration for better lifestyles and well decorated houses, there are lots of marketing opportunities within India for carpets and handicrafts which the manufacturers need to explore,” he says. Handmade area rugs and other floor coverings can adore the floor of most Indian households as a centre piece,as most houses built in India toady have large use of wood,granite and marble floorings as part of modern architecture and interior designs.

Opportunity in the Indian market is what explains the CEPC decision to participate in domestic trade show HGH India. “We have been watching this show right since inception and have a strong feeling that being part of HGH India will benefit tremendously. Here, carpet manufacturers can showcase their products to Indian institutional buyers, retailers and traders. The end purpose is always to help in increasing the income of our artisan and carpet weaver community, thus keeping them involved in this traditional art of India,” he explains.