होम टेक्सटाइल्स

Handmade Carpets Need to Tap Indian Market

Though India has been a country of carpet weaving by hand for ages, and is today a global leader for handmade carpets and rugs, it has not fully explored its own domestic market for these exquisite pieces of arts, crafts and culture. Home Fashion probed the situation and had an elaborate discussion with Mr. Kuldeep Wattal, Chairman, Carpet Export Promotion Council, to find his perspective on behalf on Indian export community.

Even as export markets for Indian handmade carpets, where India commands a whopping 37% share, continue to shrink due to weaker economic conditions in the Western countries and the demand in the Indian domestic market continues to rise, Indian rugs and carpet manufacturers have not been able to make an effective shift to this growing market. Is the Indian market opportunity for handmade carpets real? And if yes, what is holding the carpet sellers to look at this market, even as they struggle to sustain their export orders?

Prices not a deterrent

Are handmade carpets too expensive for the Indian consumers? “No, Not at all,” reacts Mr. Wattal and explains further, “India has emerged as a world leader in the hand-knotted carpet market only because of the fact that ours is the only Industry globally, which can cater to the lower, middle, higher and premium segments of consumers. Our weavers can produce carpets in economy as well as luxury range. Hence affordability of prices is not really a restricting factor in the Indian market”

It is misconception that hand-knotted carpets are very expensive and not meant for the Indian market. They can be bought starting from Rs.5,000 for a carpet in size 4 feet x 6 feet.

Of course, on the higher end, the same size rug can also be bought at prices as high as Rs. 50,000 or even Rs. 5, 00,000, depending on the yarn, fineness, and no. of knots and intricacy of designs.

Lack of Designs

Another major misconception amongst Indian consumers about handmade carpets is lack of designs and variety. Even though there has been a sea change in designs of handmade carpets over the last one decade, very little has been communicated to the consumers in India.

Today, most manufacturers have adopted to the modern design trends, leaving behind oriental and Prussian designs. Innovations have been made in use of yarns by blending different materials like viscose, wool, cotton and Jute in yarns, which allows production of contemporary, bright colours and designs which appeal to younger consumers.

This transition was very important as consumers today want their interiors to be colour and design coordinated. These days the cost has become secondary. What matters the most is how the carpet blends with the decor. Modern range of carpets made from blended fibres goes well with the modern constructions. Oriental carpets were used in oriental buildings and these days modern carpets are being used in modern flats.

Lack of Marketing

Such changes in the design capabilities of Indian carpet industry have not been communicated. Hence, the real reason for not capturing the Indian market is that the carpet industry has not promoted its products amongst Indian consumers. Information has not been disseminated to the consumers in terms of designs, product attributes and value handmade carpets bring to their homes in terms of rich Indian heritage.

Awareness level of modern handmade carpets in India is low as most consumers perceive handmade carpets as Prussian designs, oriental carpets or Kashmiri silk carpets, all of which are made with very fine knots with highest quality woollen and silk yarns. They are designed to be premium products. Today, many machine-made carpet makers copy these designs as cheap imitations and also promise low maintenance, giving severe and unfair competition to the original Indian products.

Role of Indian Retailers

Indian retailers selling carpets are doing well, but they do not wish to share their success with others. Nearly 1,000 retailers in India sell carpets. But even retailers aren’t aware about the latest developments in this sector and need to be educated. Some leading specialty stores like Jagdish Stores who have focussed on this category are doing well. They carry the entire range and wide price points to cater to all segments.

Machine-made carpets better?

There is a popular perception in India that machine-made carpets are better than the handmade ones. How far is it true? “The only reason why machine made carpets are in demand is because they have been aggressively promoted here. Therefore, marketing is the key issue. Given a choice, the consumer would prefer to have hand-knotted carpet which is hundred times better than a machine made carpet,” insists Mr. Wattal.

“Raw materials used in machine made carpets like polyester and polypropylene are not consumer friendly. On the other hand, natural fibers like wool and silk used in handmade carpets are good for health and environment. They are also better in comfort and performance in day to day usage. Machine-made carpets do not last long and are difficult to be washed.”

“If awareness is created amongst Indian consumers on all these comparative aspects, I am sure, they would prefer hand-knotted carpets, over machine-made ones,” emphasizes Kuldeep Wattal.

Need for market focus

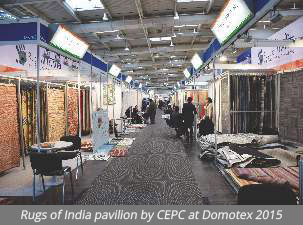

“CEPC certainly realises that India’s domestic market offers a huge opportunity, even in the global context. When the whole world is looking at India as one of the most important emerging markets for its products, there is no reason, why we should ignore it. But, for years, the Indian carpet industry has been very much focused on exports. We have been trying to develop the Indian market for some time now through trade shows like HGH India and other focussed efforts. Many exporters are trying to develop a domestic market on their own as well”, says Mr. Kuldeep Wattal, Chairman Carpet Export Promotion Council.

Indian carpet manufacturers need to have a much deeper penetration in the domestic market. We want more events like HGH India for carpet industry with a focus on Indian domestic market to come up in the future, where our participation should be of the size of events like Domotex in Hanover.

Readymade Mattresses

Most of us take sleeping on a mattress for granted as part of a good night’s sleep.

While people have always needed a place to sleep, beds and mattresses during ancient times were very different from what they are today. Mattresses, as we are being increasingly told by every producer and brand, are now part of ‘sleeping technology’ which needs to be understood and acquired by every individual to suit his or her body needs. As no two bodies are made alike, no two humans need the same mattress, according to the marketers in today’s mattress world, which keeps becoming more and more complex and advanced in terms of technology, with every passing year. Consumer prices for a mattress are only limited by how much you love your body…and a healthy and sound sleep!

Ancient Mattresses

During ancient times, people slept on natural materials like animal skins, piles of leaves and plants, moss, straw, and grasses. Back then, in Egypt, beds were for the wealthy. For example, visitors to the King Tutankhamen exhibit can see this bed from ‘King Tuts tomb made of gilded wood with feline legs.

Homes in ancient Greece and Rome did not have a lot of furniture. Bed slats were made using leather straps, and mattresses and pillows were stuffed with feathers, leaves, straw, grasses, and wool. These materials or the same furniture were used for various purposes, for example beds could be doubled as couches also for daily sitting.

Roman Woodworking gives an impression of a rectangular shaped bed sometime found in ancient Rome that had one open side for getting in and out.

A bed dating was discovered by archaeologists in 2011, giving an impression of mattress-like structure was used back then around 77,000 years ago.

Medieval Beddings

During the medieval period, bedding was largely depended on the financial status. The poor had beds with mattresses made from straw, while the wealthy sometimes had fancy beds with canopies, curtains, or decorative tapestries and mattresses stuffed with soft feathers. Fancier beds were adorned with inlay, carvings, and painted designs.

Feather beds and mattresses made of wool were highly valued assets that would get passed down in families. During the mid-18th century, mattress coverings were increasingly made from linen and cotton, and were filled with wool, horse hair, and cotton.

Modern Mattress

Coil mattresses were introduced in the 19th century – inspired from the coils used in constructing carriages.

In the 20th century changes in technology were used to create mattresses and bedding and thus in the1920s, latex was created by a Scottish getting introduced though this is only for the very high end products. The consumers’ awareness is growing and so is the quality of the retail space.

Meanwhile, during the 1930s, innerspring mattresses became widely available to US consumers, followed by the introduction of pillows and mattresses made from polyurethane foam during the 1950s.

The modern day version of the waterbed was invented by a university student in California named Charles Hall in 1968. In the 1970s,NASA created the material now called “memory foam”, and in 1992, Tempur-Pedic became the first company to introduce a memory foam mattress.

Evolution of Mattress

Modern research has proved that neck and back pains can frequently be traced to bad mattresses. An incorrect sleeping posture, leads to inadequate support for the vertebrae causing neck and shoulder pain, headaches, lower back pain, pinched nerves and sleep disorders. A bad mattress can have the same effect as a poor posture. Once a portion of the mattress sags, the part of the spine that lies over that part gets stretched. This is because the gravitational force tries to maintain the contact of the spine with the mattress. With continued stress, the individual is predisposed to back pain.

The ideal sleep system should support the curve of the spine to optimize the load distribution and minimise stress. It should be able to support the heavier parts of the body, namely the shoulders and the back, separately and the lighter parts separately. Basically, an ideal mattress should find a balance between being too hard or too soft.

Technology has been put to use to create very different types of mattresses, which suit diverse needs. The use of anti-bacterial treatments and new foaming technologies that keep the mattress fresh and ventilated have started playing an important role. Aesthetics of mattresses specially the fabrics and quilting designs have also gone through significant up-gradation. It appears that these trends shall gain more speed in the coming years. The trend of customizing mattresses is also getting introduced though this is only for the very high end products. The consumers’ awareness is growing and so is the quality of the retail space.

Today, a number of international and Indian manufacturers and brands offer a wide range of mattresses with different materials and technological innovations which drive the modern mattress industry. Some of the most popular mattresses types in the Indian market include innerspring mattresses, memory foam, gel mattresses, hybrid mattresses, pillow top, and euro top mattresses and more. Some of the important and emerging players in the Indian market, which include both international and Indian brands are listed here:

King Koil

Real Innerspring Technologies Pvt. Ltd. offers King Koil range of premium mattresses, pillows, protectors and adjustable beds. King Koil is one of the oldest premium mattress brand which was established in the year 1898. It is present in more than 100 countries worldwide and is one of the largest selling global mattress brand. It is also the largest selling hospitality brand. Over 10 million Hotel rooms are furnished with King Koil mattresses worldwide.

Eclipse

Mohit Rubber Foam has introduced Eclipse International Mattresses from USA, one of the leading manufacturers of bedding products in the world. Eclipse now stands popular in more daily sitting.

Roman Woodworking gives an impression of a rectangular shaped bed sometime found in ancient Rome that had one open side for getting in and out.

A bed dating was discovered by archaeologists in 2011, giving an impression of mattress-like structure was used back then around 77,000 years ago.

Most of us take sleeping on a mattress for granted as part of a good night’s sleep.

While people have always needed a place to sleep, beds and mattresses during ancient times were very different from what they are today. Mattresses, as we are being increasingly told by every producer and brand, are now part of ‘sleeping technology’ which needs to be understood and acquired by every individual to suit his or her body needs. As no two bodies are made alike, no two humans need the same mattress, according to the marketers in today’s mattress world, which keeps becoming more and more complex and advanced in terms of technology, with every passing year. Consumer prices for a mattress are only limited by how much you love your body…and a healthy and sound sleep!

Ancient Mattresses

During ancient times, people slept on natural materials like animal skins, piles of leaves and plants, moss, straw, and grasses. Back then, in Egypt, beds were for the wealthy. For example, visitors to the King Tutankhamen exhibit can see this bed from ‘King Tuts tomb made of gilded wood with feline legs.

Homes in ancient Greece and Rome did not have a lot of furniture. Bed slats were made using leather straps, and mattresses and pillows were stuffed with feathers, leaves, straw, grasses, and wool. These materials or the same furniture were used for various purposes, for example beds could be doubled as couches also for daily sitting.

Roman Woodworking gives an impression of a rectangular shaped bed sometime found in ancient Rome that had one open side for getting in and out.

A bed dating was discovered by archaeologists in 2011, giving an impression of mattress-like structure was used back then around 77,000 years ago.

Medieval Beddings

During the medieval period, bedding was largely depended on the financial status. The poor had beds with mattresses made from straw, while the wealthy sometimes had fancy beds with canopies, curtains, or decorative tap estries and mattresses stuffed with soft feathers. Fancier beds were adorned with inlay, carvings, and painted designs.

Feather beds and mattresses made of wool were highly valued assets that would get passed down in families. During the mid-18th century, mattress coverings were increasingly made from linen and cotton, and were filled with wool, horse hair, and cotton.

Modern Mattress

Coil mattresses were introduced in the 19th century – inspired from the coils used in constructing carriages.

In the 20th century changes in technology were used to create mattresses and bedding and thus in the1920s, latex was created by a Scottish inventor named John Boyd Dunlop and latex mattresses were introduced after that.

Furnishing Fabrics Scenario

Any question to assess the current market scenario for furnishing fabrics in the Indian market leads to such mixed reactions by the industry players that it sometimes becomes impossible to judge the real situation. While almost everybody complaints about slow demand, poor offtake and cut throat competition making it difficult to survive in the business; each one of the same players admit that their business has grown by at least 10-15% during the same period of one year.

Isn’t it a clear contradiction! Is the industry simply painting a bleak picture to ward off competition? Probably so. Home Fashion spoke to some leading players to find out if everybody is on the list of pessimists. We found that leaders with innovations are not only positive about the outlook, but are even excited about the future and growth prospects. They have been working on their new collections and are excited about the prospects of the new season starting this August. Here are some of the views expressed by them on the industry scenario in India and their own outlook. Home Fashion also takes a visual look at the innovations these leading brands are launching.

Nimish Arora

Managing Director,

Dicitex Furnishings Pvt. Ltd.

I think the Indian market is very exciting still. There are lot of opportunities. Some industry players are complaining because they are scared of competition. The established manufacturers and retailers who have been dominating the market for nearly two decades, do not want to allow competition to become wider and stronger. Hence the discouraging talks. I don’t think that any one of them are not doing well. People are doing well.”

“Like in real estate you have a tenant, a good tenant and a bad tenant. A good tenant pays well in time. A bad tenant doesn’t pay in time, but he pays. In the home furnishing industry, probably the number of bad tenants is increasing. So market looks gloomy. But one thing is certain. Supply should not exceed consumption for the competition to remain healthy. India is importing fabrics from Turkey and China. This could be hurting the local industry. The top five companies have still grown but their margins have been hit. But this also forced them to innovate more to stay ahead of competition.

They say necessity is mother of invention, I would say competition is also the necessity. Competition too is the mother of invention. If you don’t compete, you don’t grow. As we see in Dicitex, we have to improve on our previous performance. We believe in ensuring profit for our distributors and retailers because only if they make money out of the company, they will make our brand stronger.

Chirag Mehta

Director, K.C. Fabrics

Last 6 months were a dull period for K.C. Fabrics. Customers were less and simultaneously the orders were also less. However, the April and May months were good and we hope to see a rising demand from hereon. Furnishing is a seasonal business. With Diwali and Christmas season coming, demand in the market is expected to remain strong from July to January.

Market was weak last year mainly because of the economic situation. The period did not witness much purchases and construction of new homes. More than renovation it’s the construction of new homes that contributes to the sale of furnishing fabrics in India. Good quality curtains easily last for about 5 years. Besides, people spend more on furnishing new homes rather than the old ones.

We launched 2 new products in the market last year- Readymade curtains, embroidered bed sheets and achieved 10 % growth over the previous year. In 2016, we expect 15% growth in value terms. As of now, the company is not doing any imports and all the sourcing is done within the country.

Mattresses Moving towards sleep technology – by Anupama Jain

Modern life style leaves us with very little time to spare, especially for Sleep. Sleep has not been given due importance it deserves and has been taken for granted by most for a long time. The last few years saw growing awareness towards the importance of good quality sleep and not just the number of hours one sleeps. The Indian mattress sector has transformed over the years from a dull, predictable and slow growth market into an aggressive, dynamic and lucrative marketplace. Technology advancement, innovative products and the consumers’ willingness for a comfortable and durable mattress is driving the growth in the Indian mattresses market. Witnessing numerous new product innovations and launches over the years resulting in a wide array of choices for consumers, Indian mattress market has something for every consumer, ranging from general purpose to specialized products and from high priced/premium/luxury bedding to affordable products. Even though a change has come in, India has a long way to go if compared to awareness in the developed countries. The huge unorganized sector has as yet not been influenced much and it may take years to happen.

Everything that can contribute to improving the quality of sleep is gaining importance along with growing realization that agood mattress is vital for a good night’s sleep. Change at the consumer level for the mid to high end products has also come about due to increased exposure. The world has shrunk and Indians are travelling a lot. The exposure of the consumers to international brands and latest advances in sleep technology has led to the revolution in the Mattresses market. Consumers are willing to pay more for a mattress provided they see a reason for doing so. Customers are upgrading from traditional mattresses to contemporary RC/ Spring/ Foam/ Sandwich Mattresses is onthe rise.

The Indian mattress industry is Rs. 5,000 to 8,000 crore approx, of which 75% is the unorganized sector andonly 25% is organized. The potential for growth istremendous andthe combined growth of the industry is estimated at 8% to 10%, for the next few years. Of the 25% organized mattress industry, 4.5 % is the premium segment. The growth in the premium segment is estimated at around 10% to 12%, substantially higher than the overall growth. The mattress industry has grown and seen many changes but these are just small beginnings as they impact asmall percentage of thepopulation. Advent of new materials, ever increasing knowledge of the human body and the science of sleep, has brought the use of science and technology in manufacturing of mattress that assures quality sleep. This is the reason why products related to sleep are being clubbed together and the term ‘Sleep Technology’ has got coined in the mature international markets. Technology is being put to use to research and produce high quality, high technology sleep products. This is not only a trend internationally but certain market leaders in India too are introducing the same modern technologies in their mattresses. A lot of brands in India have collaborated with leading international brands bringing home those very technologies that are available in the international markets besides doing their own research and development. Leading manufacturers are now increasingly making available detailed literature with technical details and medical advantages of the products they are offering to the retailers. Products are being designed as per the BMI of persons, comfort indicators are being displayed on the mattresses, options of having one side firm while the other softer are also on offer now.

A variety of materials are used for mattresses in the international market like spring, memory foam, coir, water beds, air beds, gel mattresses and mattresses made from animal hair. “A very controlled environment and high tech machines are needed for manufacturing these mattresses. India as of now is not manufacturing that level of machinery and as such the premium brands are all using imported machines, especially German,” says Bharat Grover, Business Head, Springwel Mattresses.

Retail sector’s growth has led to a lot many changes in the mattresses market in recent years. Leading brands have responded to the demands of the consumer and many have brand stores where they display their entire range and present their mattresses in an ambiance of professional knowledge and encourage customers to experience the mattresses in order to choose the one that suits them the best. Retail environment has evolved that supports quality customer interaction. Gone are the days when a mattress was purchased from a specific market. Mattresses are now being retailed in Shopping Malls, Hyper Markets, Super Markets and stand-alone exclusive branded stores. Mattresses are also increasingly being stocked at lifestyle stores along with furniture stores as they are becoming a part of the home and lifestyle industry. Smart and educative marketing options in price points and smart salesmanship will further drive the growth at the retail level.

The Indian mattress industry is Rs. 5,000 to 8,000 crore approx, of which 75% is the unorganized sector and only 25% is organized. The potential for growth is tremendous and the combined growth of the industry is estimated at 8% to 10%, for the next few years.

Thus, the changes are at three levels manufacturers, consumers and retailers. It’s a combination of consumer awareness giving the Manufacturers an impetus to research and develop better quality mattresses and the diverse options creates’ a sense of need amongst customers. Nitin Gupta, Director, Real Innerspring Technologies P Ltd, makers of Sleepzone mattresses feels “the mattress industry is bullying in India with the entry of new players and increased customer awareness. The scenario has changed a lot in the last 3-5 years.”

The most popular mattress materials in India are-

1. Cotton mattresses- Traditionally prevalent and widely used. They are reasonably affordable.

2. Flexible Polyurethane Foam (Popularly known as PU Foam) and its value added variants like Visco Elastic foam, high resilience foam, extra firm/soft P U Foams are the highest selling in India. They are 100% synthetic and the cheaper qualities are not good for health as they generate heat and are not breathable. Its value added variants have the advantages of being more flexible, breathable, odourless, light weight, durable and can also be treated with an anti-bacterial treatment.

3. Spring mattresses are gaining popularity amongst customers, largely owing to international exposure and affordability and for those who prefer higher thicknesses and bounce.

4. Coir mattresses have dominated the market in earlier years as they have been affordable and eco friendly. Their popularity is now slowly shrinking mainly due to lesser comfort factor and availability of other options.

5. In recent years another variety has sprung up called Sandwich mattresses. As the name suggests, a sectional view of the mattress would reveal that it is composed of a hybrid of materials resembling a sandwich. These mattresses are gaining popularity because of their affordability, novelty and comfort. Water beds, air beds, gel beds and mattresses made of animal hair are yet to really find their space in the Indian market.

There had been an upward shift in the average buying prices of mattresses in India in the past few years. Earlier the average consumer would buy a mattress for about Rs 3000-Rs 5000 a pair whereas now consumers are happily purchasing mattresses inthe range of Rs 10000 to 30000 apair or even more. Of this range one can say that Rs 6,000-14,000, is the most popular price point for a king size mattress in India.

Furniture stores in India normally keep just 1-2 brands in the mid-price range. Some of them are now creating dedicated spaces. Mattresses have not gained popularity as of now in larger departmental stores and hyper marts because of the non-standard sizes used in India, logistics and warehousing issues and the policy of centralized purchasing. When it comes to EBO’s, the sales pattern is based on the price range their mattresses belong to as all EBO’s do typically keep their entire range. In the branded segment, EBO’s are the future of the market. “Sleepwe/1 mattresses are presented to the customers at our Brand Stores “Sleepwe/1 World” where we not only display our entire range but also present our mattresses in an ambiance of professional knowledge and encourage customers to experience the mattresses in order to choose the one that suits them the best,” says Manoj Sharma, VP Marketing, Sleepwe/1 mattresses from Sheela Foams.

“There have been rapid developments in the mattress industry during the last 5 years and the quality and variety of materials that are used in mattresses have changed dramatically,” feels Manoj Sharma. Technology has been put to use to create very different types of mattresses, which suit diverse needs. The use of anti-bacterial treatments and new foaming technologies that keep the mattress fresh and ventilated have started playing an important role.

There have been rapid developments in the mattress industry during the last 5 years and the quality and variety of materials that are used in mattresses have changed dramatically,” – Manoj Sharma, VP Marketing, Sleepwe/1 mattresses

International Brands have a very small presence in the India. It’s less than 5% of the organized sector and is present only in few metropolitan cities. Some of the prominent brands are Sealy, Tempur, Simmons, Serta, Hastens, Spring Air, Magniflex and King Koil, besides others. They are in India either directly or through their collaborators or partners. Sealy is marketing in India directly. Hastens mattresses, made from horse hair are priced very high and as such have had v little success in India.

Tempur-Pedic is selling in India through Springwel. The mattresses from Tempur-Pedic, a US based company, a world leader in mattresses, is made from materials that change according to the shape of the users and they also bring down the amount of motion transfer between two people using them. These are offered with limited warranties of 25 years and trial periods of 90 days. “It the only mattress and pillow recognized by NASA and certified by the Space Foundation”, says Bharat Grover, Business Head, Springwel.

Amongst the Indian Brands Sleepwell mattresses are the largest selling in the economy segment and are specializing in foam mattresses even though they make all other varieties too. Kurlon mattresses are the largest selling in the coir and variants of coir segment and Springwel are the market leaders inthespring mattress segment.

There also are other brands like Century, Duroflex, Prime Foam, MM Foam and many others in India. Rubeo mattresses are produced by Rubberized Coir Mattress Division of the Kerala State Rubber Co-operative Limited and are offering seven types of coir mattresses that serve the purposes of various types of users. The mattress segment is a critical component of the Godrej lnterio Group too and was introduced in 2007. Someshwar Prasad, General Manager- Marketing of the Mattress division, shares “the company is aiming to take up its market share in the mattress industry with regards tothe organized sector.”

The Indian and international brands are not really in a state of competition as of now as the international brands have a very insignificant presence in India as on today in terms of sales. If we look beyond sales then they have had an influence which is very important as it has helped in increasing awareness about quality mattresses and technology that goes into making one. “This has increased the interest of the Indian consumers towards high end products and has thus provided an ideal environment to the Indian brands to present their own technology driven products”, feels Manoj Sharma, Sleepwell.

The manufactures have to often deal with dealers lack of brand loyalty as there is always a clash of margins. There is an influx of brands andto beable to survive and flourish, the product has to be both, competitive for the consumer and the margins have to be good for the retailer. “In India the real estate cost is high and as a mattress is not an impulse purchase product, sustainability in investing in retail space is a challenge. This has to be kept in mind by the manufactures who are setting up EBO’s. The entire trade runs on dealer network as it’s the only way penetration can happen pan India,” shares Bharat Grover of Springwel.

“In India the real estate cost is high and as a mattress is not an impulse purchase product, sustainability in investing in retail space is a challenge. This has to be kept in mind by the manufactures who are setting up EBO’s. The entire trade runs on dealer network as it’s the only way penetration can happen pan India,”

-Bharat Grover, Business Head, Springwel Mattresses

The consumer needs to be aware that a mattress purchase is an important decision that he makes, the quality of life is directly related to his quality of sleep. Hence the amount of time and understanding that he spends on choosing the right mattress for him is critical as it becomes the basis of good health and serenity in his life. Very few Indians understand the need for mattresses to breathe. The obsession with box beds in India continue even today because the awareness isnot there that the bed needs to help the mattress to breathe by providing air vents. The other factor whichthe Indian consumer needs to understand is that areplacement of a mattress is amust as its not furniture. Maintenance issues are largely ignored by most in India like the life of a mattress can be extended by periodically rotating it and airing it and that it needs to be replaced within a maximum of 8years.

Earlier mattresses were stocked vertically where as now they are increasingly being presented horizontally. There is an experiential element which is required to help the consumer take an informed decision and the retailers are beginning to provide that. In place of showing the potential consumer, a 2 by 2 inch piece of mattress, entire mattresses are being put on display. This is true especially of the EBO’s which are stocking the entire range and have the growing presence of trained retail staff. Manufacturers are investing money and time to train front end staff so that the consumer understands what is on offer and its health benefits.

Online selling has scope for a product like mattress but at present it’s in a nascent stage in India. Most beds in India are not of a standard size and therefore mattresses have to be customized, Indian consumer still prefers to see, feel and experience the product before purchasing it, especially for the high end mattresses, it’s a bulky product which increases the cost of transportation and with it the price. Given these challenges, the convenience factor of online retail will in time still encourage sale of mattresses online. A few manufacturers like Springwel have taken baby steps in online retailing through existing portals and by setting uptheir own.

The mattress industry is realizing that there are large benefits which can be derived from advertising, trade show participation and all other initiatives that lead to increased visibility. The importance of these initiatives increase especially as the target audience is now a consumer who is beginning to seek information on quality mattresses and their benefits. All efforts to reach out to the end user contribute in the growth of an industry.

The entire trade in the mattress industry runs on a widespread and penetrated distribution network. India is a very diverse country and so logistics is a problem with preferences changing every 100 kms. Brands are recognising this fact and offering the widest possible range in different price points to ensure a large consumer base and are continuously reviewing their distribution strategy improve the availability of their products.

As the mattress market grows, it does have a positive impact on the allied products because these products go hand in hand and generally a new mattress would call for a new allied product whose product life cycle is much lower than that of a mattress. So one can say that they complement each other and they are likely to grow hand inhand.

Home Textiles: Healthy 30% market growth

India is globally recognised and appreciated for its wide variety and exquisite designs in home textiles & furnishing fabrics. The country is on the verge of a big boom in the affordable housing sector and there is good growth in employment opportunities, especially in the services sector and hence high disposable incomes in the hands of young consumers. A combined result of these factors have seen the demand for home textile products growing by a healthy 30-40% per annum.

India is home for some of the world’s biggest producers in the segment like Welspun (third largest towel producer), Trident (largest terry towel producer) and Dicitex (Fifth largest furnishing fabrics producer). Many Indian brands like Indian Drape, RR Décor, F & F, Maspar, Goldtex, ABN, Portico New York, Birla Century, Spread, Swayam, MYCK, Zyneand Super Net, etc are recognised nationally and are growing at a healthy pace. A large number of international brands like Zimmer+Rhodes, Designers’ Guild, Esprit Home, Harlequin, United Colour of Benetton have experienced a 20-30% annual growth in the Indian market.

Furnishings Fabrics

There are experts who believe that growth in home furnishings market is linked to overall health of the economy. Higher disposable incomes will translate in much higher spend on this product category. Brands and retailers have a role in making furnishings a style statement, which can ensure consistency in demand.

There are experts who believe that growth in home furnishings market is linked to overall health of the economy. Higher disposable incomes will translate in much higher spend on this product category. Brands and retailers have a role in making furnishings a style statement, which can ensure consistency in demand.

Indian furnishing market and consumers’ buying habits are certainly undergoing a change. People are no more buying only during Diwali season. With thousands of new houses coming up across the country, demand is bound to become more uniform round the year. Besides, consumers are getting more aware today. Today even a common man will tell you what furnishing stands for.

However, there are differing estimates of growth in India’s furnishing fabrics market. “Growth is good, next 2-3 years it should be around 15-20%,” says Suleman Hirani, owner of Hyderabad’s Home Textile retail chain Darpan Furnishings.” For over a decade Suleman Hirani has been into home furnishing retail and today has 4 stores in Hyderabad where he offers complete home decor solutions.

Nimish Arora, Managing Director of Dicitex Furnishings, a leading producer in the segment, expects the Furnishing fabrics market in India to grow by around 18% per annum for the next 3 to 5 years, which is in conformity with assessment of Suleman Hirani. “Organized segment experienced 40-45% growth over last three years, which amounts to less than 15% annual growth. Coming years are expected to be better,” Nimish adds.

Some industry experts differ on the growth claim. “The market is not in a very good condition,” says Mahender Pal Singh, Partner, JR Furnishings: “Big investors in the furnishings business have got stuck in real estate. Such investments were mostly to the very big players in furnishings and they are now at a disadvantage.” So according to him, small players, both manufacturers and retailers in home products are growing fast at the expense of big players.

He has an interesting point to add. “With regards to performance of the product, I can say with surety that furnishing fabric market is linked to the overall consumption spending; if consumption is increasing in arithmetic progression, spending on furnishings will increase in geometric progression, and vice-versa.”

Furnishing business is growing fast in India but competition is growing faster and as a result, profits are not what they used to be, believes Dilip Gandhi, of Bharat Furnishings, a leading specialty Home retail chain. He feels that importers have better margin as compared to domestic producers.

“Due to the internet effect, customers have now come to expect discounts in every purchase. Since overhead expenses of large stores are high, they are not in a position to meet these expectations. As a result, small stores are doing better,” he says.

“The retail scenario of furnishing fabrics has been really sluggish over the last six months,” says Gurvinder Singh, Managing Director, G M Fabrics, one of the country’s leading manufacturers of home furnishings:”Irrespective of prices and designs simply there has been no take off from retail stores.I have no doubt that the consumption by Indian consumers in categories like home fashion and home décor is growing between 15-20%. The question is, how does the furnishing fabric producer take benefit of this growth?”

Rohit Khemka, Managing Director of RR Décorsays his company’s sales have grown 10-15% per annum since the past 4 years. “But growth could be lower this FY due to subdued markets in the Middle East and Europe. We will offset the losses by using more of Indian fabrics that will fetch us better margins,” he says.RR Décor is in the role of Editor of home furnishings, selling to several countries.

Nimesh Parikh, Managing Director of Dimora Furnishing, says this year he expects growthof 60-70%. As for the overall furnishing market in India, we expect the average annual growth to be around 20-25% for the next 5 years.

Dimora has been in the furnishing fabric business for a little over 3 years now.

Prior to 1998 the Indian furnishing fabrics industry was dominated by few big brands form the North. “One big change came about in 1998 when the Bombay producers also came into this segment,” says Mahendra Gupta of Goldtex Furnishings, a leading producer in this segment.”Soon after all major players in the North switched over to jacquards and the handloom work came to be dominated by the Mumbai industry thereafter. From earlier years to now width of the fabrics have increased nearly 5 times,” he explains.

Perception on the industry

Perception on the industry

“Much of the negative perceptions in Indian market are coming from some people in the trade who are trying to enter too many verticals”, feels Nimish Arora and adds, “If Dicitex is good in manufacturing home textiles, I must try and master that before even thinking of moving into retailing. The problem arises when everyone wants to do everything,” he says.

“Perception is now changing, people have come to realise that curtain is not just fabric to be hanged, it is now a style statement for the customer.We are doing things very differently, it is all value addition to the fabric to give special effects to home interiors. Even the colour we use are subtle, people will never get bored of it,” explains Nimesh Parikh.

The perception with regards to pricing is also changing, people are today willing to spend 10 times more than what they used to 5 years back.

Consumption trend

Indian consumers today are better aware of the various sub-segments within each furnishing and home textile product segment. Brands will have to keep innovating to attract and retain customers’ loyalty. People do want to spend more money on home interiors and home décor, if they are convinced, explains Nimish of Dicitex.

Home Fashion did a survey of retailers in Western suburbs of Mumbai and found that consumers are now buying as and when they have need rather than waiting for specific occasion or season. Also, consumers are not really looking for specific brands, but only those products which would go well with their interiors. While buying, they are also not much specific about the price. So, variety in offerings hold the key.

Discounting the common perception on e-commerce affecting retailer sales, Dilip Gandhi of Bharat Furnishings says “Luckily, home furnishings is not as much affected by online discounts as other product segments because in this category shopping is mainly done by ladies who prefer closer look and feel of the product before purchasing.”

Way forward

Nimish Arora of Dicitex believes furnishing demand was never negative in last one year. It is just a psychological factor. “The India consumption story is being studied by the world. A Chinese mill owner told me that Indian market is a gold mine of 1.2 billion young consumer base. A little bit of rational thinking will show up the potential this market has,” he argues. Manufacturers should refrain from over flooding the market as that will hurt prices and also retail margins.

The industry will have to take in to account competition emerging from cheaper producers, design counterfeiters, and importers in order to remain healthy, even as it maintains the volumes, advises Gurvinder Singh. “The only possible way of growth is to evolve your product and strategy according to emerging market scenario. Those who are able to do it can look forward to a good future,” he concludes.

Bed linen: Despite odds, growth assured

Arun Roongta

Arun Roongta

While today’s well-known brands like Portico and Spaces successfully challenged the market leader Bombay Dyeing’s supremacy, some others like Trident are preparing to do so. Players like Swayam, Tangerine, and Maspar and House This! too are successfully carving out their own niche in a market still cluttered by and large with unbranded bed sheets and pillow covers across the country.

Despite a healthy growth of 15 to 20% in consumer demand in the rapidly growing Indian market for bed linen, individual players has been facing tough times and challenges for the last one year. The situation is perceived differently by different market players. While everybody agrees that the competition has become more cut throat than ever before, to some extent thanks to the onslaught of online retailers, every player has his own perspective on the current situation and differ on what does the future hold for the industry and for their own brand.

Home Fashion spoke to some key players to find out their current outlook and their opinion on prospects for their brand and bed linen sector in general. Bombay Dyeing, still the market leader in bed sheets, continues to command the best brand recall with Indian consumers, has not been accessible for their views and comments despite repeated efforts by Home Fashion. Other leaders shared their opinion. Here are the excerpts:

Vijay Agarwal Chairman, Creative Portico

Vijay Agarwal Chairman, Creative Portico

Bed Linen market in India has a fantastic future. At the moment, branded products comprise just about 2% of the market. Since the new age Indian consumers increasingly aspire for high quality and branded products across all categories, bed linen will be no exception. Good brands will become very popular in coming years.

Creative Portico is growing at almost 30-40% every year and the brand is also doing very well. In view of the ever rising e-commerce phenomenon, we feel it is necessary to gain maximum market penetration through that space as quickly as possible. So we are exploring e-commerce option as part of our sales strategy.

The market needs more options and we are planning to add more sophisticated, performance-enhancing and value-added items for better health, more comfort and superior lifestyle. Earlier, the reality of Indian market was that it is all about printed bed sheets. Today the consumers seek more variety, more functions, luxurious feel, better health, eco-friendly products and innovative features. Portico New York is offering solutions in all these directions.

Over the past couple of years the retail price of bed linen products have gone up a little but there is not much scope for further appreciation in the given market scenario. Market is expected to grow at least 25-30%.

Dipali Goenka, Managing Director, Welspun Global Brands Ltd

Dipali Goenka, Managing Director, Welspun Global Brands Ltd

Estimated value of Indian home Linen market is Rs.1,400 crorein the organized sector and Rs.12,600 crore in the unorganized. The category has grown at around 8% annually over the past 3 years and growth projections for the next 3 years are also similar.

Estimated growth of Spaces was between 24% and 30% over past 3 years and it is projected to be between 30% and 38% for next 3 years. Currently, Spaces is among the top three home brands in India and aspires to be the leader in branded home segment.

Apart from Towels, bed sheets, comforters and rugs, we have recently launched Areas Rugs across India and plan to launchBasic Bedding (pillow fillers, mattress protectors) in the coming months.

The Indian Home category is dominated by few major players and Spaces is one of them. Innovation, Quality and Product performance are the pillars for us to stand out among competitors. Marketing and branding activities in the proper channels is important for success in Indian domestic market. We are positioning our brand accordingly and have increased the marketing spends significantly. There is a lot of potential in branded segment across channels,namely Sales and Distribution(S&D), Shop-in-Shop, E-commerce, Corporate sales etc.

S&D is a major activity for us to tap huge potential for growth and we are taking all the necessary steps to tap emerging Indian market. We also plan to launch Spaces globally through our global e-commerce portal. We already have Welspun E-com operational in UK, US, Germany and Australia.

Appointed Parineeti as brand ambassador of Spaces was an important move and we got great leverage from the same last year. We have increased our marketing spends, completed branding activity across India in 200 plus high street furnishing stores and are conducting regional and national events to expand our reach.

Manoj Garg, Managing Director, Swayam Linen

Manoj Garg, Managing Director, Swayam Linen

Indian bed linen market has been growing at the rate of 25 to 30% over the last three years, year on year across all price and quality segments. Swayam has itself has been growing at 30 to 35% per annum. Reason for such high growth is that Indian consumers started spending money on bed linen only 5 years back. Today, bed linen has become a fashionable product.

In USA people change bed linen every day whereas average Indians changes it once every week. So having 4 bed sheets in the cupboard is considered sufficient here whereas the requirement would be seven time more in developed countries.

Speaking of our own brand Swayam, 3 to 4 years back if the average selling price (ASP) of a product was Rs.800 and segment wise sales break up was 85% printed and 15% solids. Today, the ASP of the same product has reached Rs.1,400 and segment wise sales stand at 80% printed and 20% solids. The shift towards solids is evident.

Speaking of our own brand Swayam, 3 to 4 years back if the average selling price (ASP) of a product was Rs.800 and segment wise sales break up was 85% printed and 15% solids. Today, the ASP of the same product has reached Rs.1,400 and segment wise sales stand at 80% printed and 20% solids. The shift towards solids is evident.

Over the next 3 years we estimate 30-35% growth YOY. As stated, average consumption of bed linen is low in India with an average consumer here spending only 8% on home textiles of what she spends on apparel. This share should go up to 20% to come at par with developed countries. Bed sheets comprise 30% of our imports of home textiles, which is around Rs.5,000 crore and 90% of bedsheet imported is polyester.

Today Swayam products are available in 200 stores across India, which should become 400 stores in the next 3 years, giving our brand deeper market penetration.

Mohit Modi, Managing Director, Spread Home

Mohit Modi, Managing Director, Spread Home

Even today, the branded bed sheet market in India has been growing at 10% per annum while the unbranded continues to grow at a faster rate of about 15%, clearly showing Indian’s preference for cheaper, unbranded products at mass level. Overall consumption of bed linen is increasing by 13% on an average. In India, even today, over 90% of bed linen buying at retail level is done by housewives, which is a very different scenario from a country like USA, where men are almost as important buyers as women.

This is an established fact that women tend to be more economical shoppers than men and do not spend simply on a brand unless they find product value too. We have been selling international brands like Esprit Home, Tom Tailor and Pierre Cardin in India for over 15 years. But it is only now that we started seeing the real growth in demand. Our own brand Spread, which again is based on high quality international products which we import, has been our real saviour, where we have not only established ourselves firmly as a brand, but also have been growing consistently for over 10 years.

The market is now getting segmented, choice of designs and products are getting linked to segment wise profile of the consumer and hi-end solids are becoming popular in bed linen for the first time in India.

In our experience, it is evident that brands which deliver product value in India, will be the long term winners here.

Rajiv Merchant, CEO & Co-founder, Tangerine Home Couture

Rajiv Merchant, CEO & Co-founder, Tangerine Home Couture

While Indian market for bed linen has been growing by about 15%, growth has been higher in e-commerce. Today e-commerce commands over 10% of total bedlinen sales in India. The Rs.1000+ bedlinens still have only 15-20% of market share in India, 10 years back their share could have been still lower between 3-5 %. Hence, it is a welcome growth.

Home textile consumption in India is growing at 15% per annum, but the potential is for 20-25% growth. One of the restricting factors is lack of modern retail infrastructure to support this growth. It is likely that we will see higher growth in the Rs.1000 plus price category.

On the shop floor, bed linen is always considered a small category. Retailers who focus on it have done very well. Change in attitude of specialty home retailers took place only after LFS launched specialized LFS home stores like Home Centre, Home Stop, Home Town and @home. These formats provided good space to bed linen and customers automatically looked at it seriously.Big Bazaar has contributed immensely in popularizing bed linen. A small but upcoming trend is also visible towards fitted sheets. Demand for comforters and quilts is also growing. Private labels of Large Format Stores are experiencing double digit growth as they offer good prices.

E-commerce sector has also pushed this category amongst younger, below 35 years of age consumers. Big outlets like Jagdish Stores, Home Stop and Home Town will survive on the 35 plus age group of customers who have real buying power. Indian manufacturers have upgraded quality and capacities as a result of which, import from China is largely confined to polyester and cheaper cotton items.

E-commerce sector has also pushed this category amongst younger, below 35 years of age consumers. Big outlets like Jagdish Stores, Home Stop and Home Town will survive on the 35 plus age group of customers who have real buying power. Indian manufacturers have upgraded quality and capacities as a result of which, import from China is largely confined to polyester and cheaper cotton items.

Tangerine has experienced more than50% growth in its second year of its launch. Tangerine MRPs range between Rs.1500-3000. Tomatillo, the second brand has been introduced at MRP of Rs.1000.

“Cotton Made-ups & Yarns India’s Key Global Strengths”

R. K. Dalmia, Chairman, TEXPROCIL

R. K. Dalmia, Chairman, TEXPROCIL

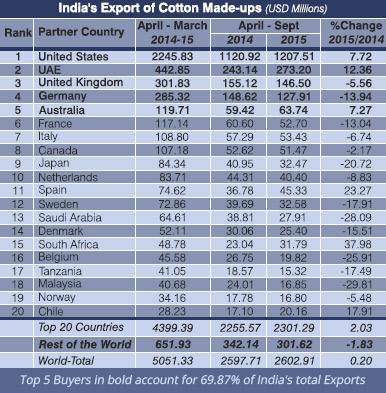

World trade in Textile & Clothing showed a decrease of 7.03% during the first 7 months of 2015, with some interesting observations.

Amongst the top 10 global exporters, who command 70% of the world trade in textiles and clothing amongst themselves, Bangladesh (+3.44%) and Vietnam (+10.66%) are the only two exporting countries which showed positive growth in their exports during this period. India (-4.59%) and China (-4.64%) were the only two other exporters, who were able to contain the fall in their exports to below 5%. All other countries like Italy, Germany, France, Hong Kong and Turkey reported a decline between (-) 8 to (-) 16.5% in their exports.

Similarly, during the same 7 months, overall world imports declined by 7.03%. Interestingly, while 9 out of the top 10 importers who together account for 60% of world’s total textile and clothing imports showed a negative growth in their imports, ranging between (-)1.59% to (-)13.45%, USA is the only one showing a positive growth of 4.71%. This clearly indicates the strength of American market and economy both even against all odds.

Mr. R. K. Dalmia, Chairman, The Cotton Textiles Export Promotion Council (TEXPROCIL) and Mr. Siddhartha Rajagopal, Executive Director, TEXPROCIL in an interaction with Arun Roongta, Editor, Home Fashion magazine shared their views on diverse subjects concerning world market situation and India’s cotton textile industry and its export prospects in the coming months. Besides the global overview, India’s current and expected position in the world market in different cotton textile product categories emerged clearly in this interaction. Excerpts from the interaction:

World Overview

All textile exporting nations are bound by WTO agreement to do away with all subsidies by the year 2018. Under the circumstances, only way India and every other textile exporter can stay in the market is by improving efficiency, being innovative and becoming competitive on merits of performance.

India’s global position

Our share in world textile trade has increased from 3% to 4% over the last 10 years. In my opinion, it should reach to 5% in the next 2 to 3 years, as both our made-ups and garments are doing better. In made-ups, we already have a share of 8% and are doing well. Only problem area currently is yarn export, which has been India’s traditional strength and we hope its market will recover soon. Our challenges here are that China is not buying as much as it used to and Bangladesh and Vietnam are setting up their own spinning. Yet, nobody can beat Indian yarn quality and our study shows that India will remain leading global yarn supplier.

India’s Exports

India’s Exports

During FY 2014-15, India’s cotton textile exports amounted to USD 11.5 billion. From April to Oct 2015, cotton textile exports declined by 2% but readymade garment exports went up by about 2-3%. So overall, exports this year may remain stagnant or even go down marginally.This is also because there is huge pressure on prices and margins are going down. For example, in case of cotton yarn while in quantity terms exports have gone up by 12%, they are likely to be down by 12% in value terms.

Home Textiles exports

India is really doing well with home textiles export. Home textiles are comparatively less labour intensive and more capital intensive due to higher automation. Therefore, capacities in organised sector are increasing rapidly. Home textile companies like Welspun and Trident are really doing well and are increasing capacities. In my view, India can effectively compete globally and increase its share substantially in home textiles.

Key Markets

USA

Made-ups market in USA is good and is growing by 8-10%. 48% of our made-ups exports go to USA and our exports to USA are growing by about 10% per annum. USA economy is doing well. Unemployment is low, interest rates are low, and new investments are taking place. Its exports too are doing well. All this augurs well for the economy. So USA demand is likely to remain reasonably strong in coming years.

European Union

European Union

EU was expected to pick-up, but it did not, inspite of macro-economic factors being favourable. Loan position is easy; interest rates are low; companies have money; and yet investment is not taking place in Europe for various reasons. Now Europe has got the refugee crisis, it got caught in terrorism, it got caught in border conflicts, so there is bit of a weak sentiment now, Continental Europe is not doing too well. Germany is stable and its exports are growing by 8%. But now it is feeling the pressure because of others. France got crashed because of its own crisis. Italy is not doing too well. Portugal, Spain too are subdued. Others are too small. In EU, UK is the only country, which is doing well.

In fact, today, after USA, UK is the best performing economy in the West. Unless something drastic happens UK will continue to perform well in the foreseeable future.

Emerging export markets

As developed markets get saturated, India has to focus on emerging markets like Middle East Asia,other Asian countries, African and Latin American countries in the longer run. Exports to Latin American countries like Peru, Argentina and Chile are increasing. But the banking system is very poor in countries like Russia, Eastern Europe, which is a challenge.

Big consuming markets are USA, China, Brazil and India itself. Of this China wants more luxury goods, as they attract no duty or very little duty. We are trying to get our high end fabrics and made-ups into China duty free. We are also trying routes like AFTA, RCET.

Brazil is another big consuming country, but unfortunately, is highly protectionist. It does not allow import of so many products like cushion covers and bed sheets.

Middle-East is a good market, but there is no volume in it.

India’s export competitiveness

We need to be more innovative in our textile manufacturing, like we are in some other segments like IT. In my opinion, we are quite competitive in products like yarns, apparel fabrics and home textiles. But we need to work harder on readymade garments and other value-added finished products. Smaller countries like Bangladesh, Sri Lanka and Vietnam are giving us tough competition. Countries like Bangladesh are also putting spinning and weaving, but primarily for self-consumption and do not pose serious competition in these products. In fact, India will continue to export some quantity of yarn and fabrics to China, Bangladesh and Sri Lanka.

Besides, despite WTO, there are different regional, bilateral, multi-lateral trade agreements, which create advantage for some of the emerging competitors. For example, Vietnam is going to benefit from TPP agreement where the condition is that for finished products supplied from Vietnam even the yarn should be produced in Vietnam only. Hence, despite countries like India having huge spinning capacities, Vietnam will get new yarn factories and we may face some loss of market.

Competitiveness vis-à-vis China

India is today more competitive than China from yarns to fabrics to made-ups. I foresee that we will export fabrics in a big way to China in the future. India is slowly acquiring labour cost advantage over China, the effect of which will be eventually visible. Indian cotton fabrics have a good potential in China, if duty is reduced little further from current 8% to 10%. We can review our trade treaties with China for mutual benefits.

India’s domestic market

India’s domestic market growth is about 20% per annum, which is one of the best in the world today. If export growth has come down, domestic market is growing. So the situation has to be seen in totality. India, in global context, is today one of the largest consumers of textiles, and we must focus on it.

India’s young population is huge, fashion-conscious, aspires to follow international lifestyle and has high disposable income. Hence, demand and consumption in India is bound to be vibrant and will grow rapidly. I think, Indian textile industry’s survival and growth will be highly supported by domestic market growth in the years ahead.

India’s growth prospects

Current size of India’s Textile industry is about USD 100 billion, of which about USD 41 billion worth of goods are exported. India is in the process of working on its textile export target of USD 300 billion by 2025, set by Government of India. This is very ambitious and challenging, but achievable, if we act with clarity and determination on both domestic market and export fronts. We have been making huge investments in textile sector every year. We need to similarly work on our infrastructure, labour laws, reduction in transaction costs, export competitiveness and business friendly environment. Equally, we need to work on favourable import duty structures for Indian products in our key markets.

Our home textiles and garments are doing very well in USA, but we can’t sell much of yarns and apparel fabrics there. Our made-ups exports to USA are growing by 8-10% per annum. We are also doing fine in Europe, but with some challenges, as product and volume requirements in Europe are different from USA. Indian made-ups and fabrics have good demand in Australia. UAE exports, primarily for made-ups have shown huge jump in last two years due to high demand and our sustained export promotion efforts. Boom in its real estate and hospitality sectors have contributed positively.

With Japan we have bilateral agreement with zero duty. But our penetration is low there because it is a very demanding and perfectionist market; logistically we are not very well connected and Japan’s economy is also slow at the moment, Making entry in that market very difficult.

India’s International Investments

Indian textile industry is now investing in countries like Ethiopia, and Vietnam since labour cost there is still low and these countries are offering good terms for investments and provide cheap land. TEXPROCIL delegation was recently in Vietnam as we see high chances of success for Indian investment there. Besides, Sri Lanka, UAE and African countries too have investment potential for India.

Future Trends

Efficiency and creativity will matter in the end. It is not a question of size or scale today. It is simply about being competitive and offering right solutions at the right time at the right place. Textile market exists in all quality and lifestyle segments. It for the individual exporter to position himself in the right slot and focus on it. What will matter is the ability to deliver value at the end of the chain. Today size does not matter, ability to compete effectively, does!

Handmade Carpets: India retains global leadership

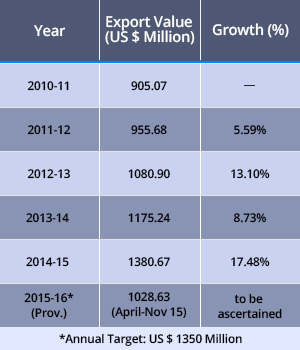

India has an unchallenged global leadership in handmade carpets with an impressive 38% share in world exports. Unique designs and skilful hand-knotting, hand tufting and hand weaving leave international consumers simply in an awe. No wonder India has managed to increase its exports for the fifth year in a row, despite sluggish market conditions. In FY 2014-15 India’s handmade carpet exports went up by a healthy 17% over last year.

India has an unchallenged global leadership in handmade carpets with an impressive 38% share in world exports. Unique designs and skilful hand-knotting, hand tufting and hand weaving leave international consumers simply in an awe. No wonder India has managed to increase its exports for the fifth year in a row, despite sluggish market conditions. In FY 2014-15 India’s handmade carpet exports went up by a healthy 17% over last year.

Carpet Export Promotion Council (CEPC) has played a key role in establishing this lead over the last two decades through consistent efforts towards skill development, market promotions and fulfilling Corporate Social Responsibility. It regularly runs several projects towards education, health, social welfare and social infrastructure in clusters like Bhadohi. CEPC also acts as a catalyst among international buyers, Indian exporters, Government and the carpet weavers.

Last year, handmade Carpets earned India foreign exchange worth USD 1.38 billion. Over 2 million rural artisans, including women, are employed by this sector.

Despite stiff competition from machine made carpets and other floor coverings like wooden flooring, vinyl, marbles, ceramic tiles and synthetic alternatives, Indian handmade rugs & carpets are preferred by discerning consumers for their cosy, warm feeling, unique textures, colours, designs and materials. Handmade carpets support sustainable, environment-friendly economic movement too.

India offers unique carpets and rugs in blends like cotton-jute, jute-wool silk-blends and other combinations with wool and silk. Indian weavers are quick to respond to diverse design & product needs. That is why, despite severe competition, Indian handmade carpets continue to enjoy increasing demand worldwide.

In an exclusive interview with Mr. Kuldeep Raj Wattal, Chairman, Carpet Export Promotion Council reveals the latest international market scenario for Indian handmade carpets to Home Fashion Editor, Arun Roongta.

HF: What is the current position of India’s carpet exports?

KW: Inspite of many ups and down in international markets, 2015 was a steady year for us. Problems like migrants from Syria etc. have disturbed economic sentiments in Europe. Other regional economic and political problems too have adversely impacted our carpet exports. But demand in USA has picked up, increasing its share in our exports up to 45-46% from 35%. This set off the decline in European share, enabling usto maintain our export growth at 10-12%, which considering the market conditions, must be considered healthy. During FY 2015-16, we shall meet the target of Rs. 10,000 crore, which is much higher than Rs. 8,600 crore in FY 2014-15.

Though demand for some of our regular items like shaggy, Indian carpet exports has slackened, we are doing better than our competitors. India has a highly diversified product range priced from USD 10 to USD 1,000 per square meter, which can all market segments- low, middle and high. With such varied price and product options, it is easier to sustain our export growth as some products are always in demand. This year, low-priced(USD 25-40 per square meter) products like hand-tufted carpets have done well.

HF: How is Chinese market emerging?

KW: Chinese are very fond of hand-knotted or handloom carpets, as they give real handmade feel. Wool and cotton handloom carpets have boosted our exports to China.The Chinese particularly admire Laurie Baft and geometrical designs. But they do not like carpets with backing which give a machine-made look.

With more aggressive marketing in China, demand for Indian carpets can grow bigger and faster. Despite big potential, very high import duty of 35% is hampering business in China. Indian Government needs to resolve this with its Chinese counterpart.

HF:And what about Middle-East Asia?

KW: Middle-Eastas a market has been stable. Demand is primarily for classic oriental and silk carpets. With Iran’s production going down, India is becoming more popular here. It has both quantity and price advantage over Iran, leading to increased demand for fine Indian silk rugs. In value terms, this market has been stable, which under current conditions is a good achievement.

HF: In 2015, which countries contributed to export growth?

KW: Germany and USA continue to be the biggest markets for India. UK is important, but holds only 10th or 11th position.

I think China will acquire second or third position soon from its current 10th or 12th position. We have just started promoting Indian carpets in China. Chinese people really like them. From just one trade fair participation, we are increasing to 6 or 7 trade shows in China. Response from the trade and consumers is tremendous, which is the first requirement to succeed in a large market like China. We need to create more awareness for which Government of India support is also required.

HF: What kind of support?

KW: Primarily in product promotion. For example, in organising exclusive Indian carpet shows in China, putting up promotional road shows to explain unique features of Indian carpets. These can be part of larger Indian cultural and country promotion activities in China. We need to showcase that Indian carpets are world-class products, with excellent price and value for money.

HF: Where does India’s share stand in world market?

KW: It remains at 37-38%. We are optimistic to increase it further.

HF: Do you see a major impact of the Middle-East crisis like Syria on India’s carpet exports?

KW: Crisis like wars and instability always cause a concern in any market and their impact definitely percolates down on the people. They start worrying about the basics and lose focus on luxury items like carpets. So, some impact would be there.

HF: Are Far-Eastern countries like Korea, Taiwan, Thailand, Indonesia and Australia emerging as markets?

KW: We have preferential trade agreements with most of them. For example we have CEPA with Korea and Japan. We are even allowed duty free export in some countries, yet their imports are not going up.

HF: What about African and Latin American countries?

KW: Latin America can be a big consumer of Indian carpets, but at 35-38%, import duties are very high, increasing the landed cost for buyers. If import duties become realistic, potential for export in these countries is good.

HF: How much is the import duty in other countries?

KW: It is much lower. 8% in Europe. About 6% to 8% in USA.

HF: What about Turkey? It was emerging as a big market for the last few years?

High Relevance for India

Domotex in Hanover is the most important annual global trade show for rugs, carpets and floor covering industry, where designers, manufactures, importers, wholesalers and retailers from all over the world converge for their annual meeting and business discussions.

Domotex in Hanover is the most important annual global trade show for rugs, carpets and floor covering industry, where designers, manufactures, importers, wholesalers and retailers from all over the world converge for their annual meeting and business discussions.

From India’s perspective, it is the largest exhibiting country at Domotex, which is well justified as it offers one of the most diverse range of handmade carpets in the world and commands the highest 38% share of the world market.

Domotex allows Indian carpet & floor covering manufacturers and exporters to not only interact and transact business with the buyers from all over the world, but also understand the latest market and product trends, upcoming fashion, design and colour trends, new techniques, materials and technologies with current international perspective. In a way Domotex unfolds the next buying season for Indian exporters, while allowing our manufacturers to unveil their latest creations to the world simultaneously.

KW: Though Turkey was a big importer, its buying reduced suddenly as import duty on hand-knotted carpets was increased form 8% to an obnoxious 50%!

KW: Though Turkey was a big importer, its buying reduced suddenly as import duty on hand-knotted carpets was increased form 8% to an obnoxious 50%!

Today, import duty structure is a major hiccup in markets like Latin America, Turkey, China and Russia. This can be resolved only with Indian Government support

HF: Does India import carpets too?

KW: Only machine made carpets. But there is no competition between hand-made and machine made carpets as buyers are different for both.

HF: What is the share of handmade carpets in overall global carpet consumption?

KW: Only about 10-12%.

HF: Why such a low share?

KW: Because in the contract and projects markets mostly machine made carpets are popular. These segments are the major carpet buyers in the world. Handmade carpets are more the pieces of art and craft, which are asked by the discerning buyers. They are log lasting too!

HF: Are Indian manufacturers switching over to machine-made carpets as well?

KW: Some of them are. But only to cater to the domestic demand. But for exports, there is no production of machine made carpets. As India doesn’t have much production of machine made carpets, lot of cheap machine-made carpets are also being imported. But in the international market, India is clearly known for handmade carpets only. Those who desire hand-made ones, prefer to depend on Indian manufacturers, as Indian is amongst the best and cheapest in the world in this category. That is why we have such a large (38%) share of global handmade carpet market!

HF: But why can’t we export machine made carpets too, in addition to the handmade ones, if the market for machine made ones is so large?

KW: At least for now it looks difficult for India for several reasons. First of all we have no cost or any other strategic advantage in this segment. For example, Turkey is one of the biggest exporter of machine-made carpets to Europe. It has duty free access in that market. Others’ products will attract 8% import duty. Even countries like Iran buy big quantity from Turkey. There again they enjoy favourable trade terms.

We do not have raw material for machine made carpets, which we have to import from counties like Turkey. So on one hand we have to import raw material and on other hand face import duty on finished goods. Besides, distances to the markets are longer. How can we stand such a competitive scenario?

HF: What about Belgium?

KW: Belgium is today more or a producer for carpet making machinery rather than being a producer for machine-made carpets.

HF: Where do you see the demand trend going for handmade carpets in the next one year, especially in terms of products and designs?

KW: Abstract designs are a major trend. People have been buying oriental designs for quite some time and certainly seek a change now. In terms of materials wool and viscose blends and pure viscose will be preferred over pure wool. This is because the younger generation prefers the fashion elements like shine, resilience and strength of viscose. They do not want very long lasting, but bright, trendy and cheaper floor coverings, which they can change frequently.

Popularity of polyester based, hand tufted shaggy carpets is being replaced in the last 2-3 years by wool-viscose items, which are popular in both hand-made and handloom categories.

In terms of pile and thickness, trend remain the same as before, but colours, designs and materials are in for a change.

HF: What is the current situation with Kashmir, especially with its silk carpets?

KW: Silk carpet production is quite stable. With neither a surplus nor a scarcity of goods, the demand and supply situation for silk carpets in Kashmir is quite balanced. There is no disruption in regular production and hence the situation is healthy.

HF: What is the status of the Training Programme for carpet weavers started by the Council recently?