हाउसवेयर

The Houseware Market and its Potential for Entrepreneurs in India

As consumers get more used to branded and better products and buying through organized retail channels, opportunities for entrepreneurs in houseware segment will become larger and larger in the years ahead.

Entrepreneur.com Date: March 28

India is forecasted to become the 5th largest consumer market in the world by 2025. Currently, the country is experiencing a 12 % year on year growth in consumer expenditure as against a global increase of 5%. 100 plus million middle-class Indian households will show high growth in their consumption pattern owing to increase in their incomes and moving them upwards into affluent and elite segments.

The retail industry in India has emerged as one of the most dynamic and fast-paced. With the constant entry of several new players across a variety of product categories and retail formats, by the year 2020, India’s retail market is expected to increase by 60 per cent to reach USD 1.1 trillion. Organised retail in India has been growing at about 25% per annum. Its current share in overall Indian retail stands at over 7%.

Indian Houseware Market

Houseware is a growing category in the Indian domestic retail market with an annual growth of 25-30%. From the traditional to the modern society, across the globe, houseware has always existed as a major product category in the marketplace. India has also witnessed a major shift in buyer or consumer base for houseware products and it is no more restricted to women.

Production of standard quality cookware, tableware, kitchenware, kitchen tools, storage, kitchen appliances, cleaning and general houseware, and products in India is still very limited and hence, the market is also fed through imports. There are hundreds of importers and distributors, who either import and sell under their own brands or represent international brands in India.

Trends in Houseware Industry

With evolving lifestyle of Indians, India has witnessed a major shift in the houseware industry. Due to the high degree of urbanization, the proliferation of nuclear families and technological advancement, there have been far-reaching changes in the nature of houseware products. In India, globalization has also brought about significant changes in cooking, serving and dining habits.

For young working couples in the urban setting, there have been wide-ranging changes in lifestyle, in their socializing and food habits. Factors like healthy cooking, convenience, safety, functionality, time-saving devices and cookware are now driving the purchase decision. The complexity of the products also makes it necessary that husband-wife both engage in the purchase of these products – be it kitchenware, cookware, tableware, kitchen appliances, storage, cleaning or maintenance products, outdoor houseware, or travel goods, one can see the drastic change in the market scenario. Most of the modern day houseware products are now made by combining materials like steel, plastics, ceramics, glass and so on. Hence the market classification is now less material-driven and more utility or functionality-driven.

Home Retail Scenario and Potential Opportunities

Home and home improvement are amongst the fastest growing categories for most retail chains (departmental stores, hypermarkets & speciality stores). Backed by leading retail houses, several big specialised home retail chains have emerged. Leading international specialised home retailers like IKEA are in the process of investing Rs 10,500 crore to set up 25 stores across India. Amazon Inc. has announced an additional USD 3 billion investment in India operations, thereby taking its committed investment in the country to over US $5 billion.

Aspirational demand across segments will also drive the consumption and consumer spending upwards. Increasing number of nuclear families and their keenness to invest in their own homes is leading to a consistent growth in housing sector, which is bound to push demand for home products like home textiles, houseware and home d?cor. It will also push upwards the market for consumer durables. With rising affluence, consumers are bound to move beyond functionality in their purchases and will increasingly spend on lifestyle factors like d?cor, design, trends, fashion and aesthetics. All these factors create a potential market for entrepreneurs to tap into and explore huge opportunities in India in manufacturing, retail, distribution and imports. Retail will obviously be the biggest of them all.

Traditionally, houseware products were more utility-driven with a high focus on functionality, labour saving and simplifying domestic chores. Today, such products are already well accepted by consumers across all market segments. But the Indian houseware industry missed the retail boom enjoyed by categories like apparel and food in India over the last 25 years, as the majority of its products lacked good design and glamour of branding. Retailers always identify retail space allocation with big brands and well-designed products. As the houseware sector emerges in its contemporary avatar with focus on good design, high technology, branding and glamorous presentation, retailers are discovering a great opportunity in this segment as both unit prices and margins go up. With the increased allocation of retail space as well as the entry of e.com players, houseware business is poised for substantial growth.

India, however, remains one of the most complex countries to manage and build businesses in. The market requires an in-depth consumer understanding and is not only price and value sensitive but also unorganized. Nonetheless, Indian houseware market’s potential and growth aspect are appealing to major international players.

Entrepreneurs have to understand that while the market is sizeable they will have to keep a few factors in mind to conduct business successfully. One needs to understand the substantial size of the market for the particular product category in different retail channels and the strength and weaknesses of each major player present in the market. As consumers get more used to branded and better products and buying through organized retail channels, opportunities for entrepreneurs in houseware segment will become larger and larger in the years ahead.

Sales of air purifiers, masks skyrocket

The market for air purifiers is confined to northern India, which contributes close to 80% of the annual sales of Rs 500 crore

Arnab Dutta | New Delhi Last Updated at November 9, 2017 01:28 IST | Source: Business Standard

Air purifiers, masks and respirators have been flying off the shelves since the capital region has come under a thick layer of smog.

Since Monday, sale of air purifiers has doubled. When air quality worsened on Tuesday, marketers saw a 250 per cent jump in sales.

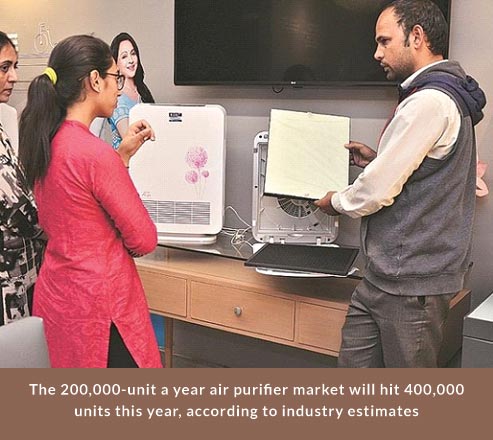

The market for air purifiers is confined to northern India, which contributes close to 80 per cent of the annual sales of Rs 500 crore. For the past few years, the market has been growing by more than 50 per cent. However, growing awareness among consumers — thanks to promotional activities by all major marketers — got more consumers into retail outlets this time. According to industry estimates, the 200,000 units a year market will hit 400,000 units this year. “We have sold some 7,000 pieces in November, which is 250 per cent higher than the sales in the same period last year,” said Kishalay Ray, president, consumer electronics division, Sharp Business Systems. “During October, too, year-on-year sale was better as we saw 2,800 units fly off the shelves. But sales have skyrocketed since yesterday.”

To cash in the growing demand for air-purifying systems, the firm had recently ventured into specialised categories, apart from car and room air-purifiers.

Other consumer durable makers were not too far behind. Korean major LG, Kent and Crompton Greaves have launched air-purifiers in the past few days. Kim-Ki Wan, managing director, LG Electronics India, said: “Air quality has been of pressing concern for consumers. Based on this insight, we have developed the latest LG air-purifiers.”

Syed Moonis Alvi, business head-purifiers, Panasonic India, said the firm has achieved sales of Rs 2 crore in October 2017, with a 20-25 per cent jump over last year. “We are targeting sales of Rs 7-8 crore till December 2017. We are at 8 per cent market share and hope to achieve 10 per cent market share by the end of 2017-18.”

Sudhir Pillai, a general manager at Honeywell Homes and Building Technologies, said: “Over the last two days, we have seen a more-than-fivefold spike in sales and 8-10-fold increase in enquires at our customer care centres. We are already selling aggressively through both online platforms as well as large and small-format retail stores.” Many shops ran out of stock of face masks and respirators. Jai Dhar Gupta, founder of Nirvana India, a seller of designer masks, said supply constraints were a concern as demand was seasonal.

Indian Houseware market growing by 25-30%

Newly introduced Hall 5 at HGH India 2016, the largest annual trade show for Home Décor, Gifts and Houseware industry, which has been reserved exclusively for houseware and gifts witnessed very high number of serious trade visitors including houseware retailers, department stores home store, department stores, online retailers, corporate gift buyers and institutional buyers.

The visitors comprised of top-end decisionmaking retail professionals who come for their annual sourcing requirement, to find new business opportunities, and to understand upcoming fashion, business and market trends in the houseware category. With the increasing demand of the houseware category in India, this year HGH India has made sure to focus a lot more on Indian and International brands in this sector.

Houseware is a growing category in the Indian domestic retail market with an annual growth of 25-30%. Products from over 100 exhibitors and brands from India and many other countries from Asia and Europe like Thailand, Korea, Vietnam, Malaysia, Turkey, UK, Germany, Italy, France and USA have taken part. This year, there is a dedicated Chinese Pavilion with above 40 exhibitors at HGH India, 2016. Going by current trends, it is expected to more than double in HGH India 2017.

Major brands in the houseware sector that were present at the show were Crystal Bohemia, Luminarc, La Opala, Kilner, Borosil, Cello, Trinity, Corelle to name a few. In addition to these, many new Indian and international brands have already confirmed their participation in the upcoming sixth edition, clearly indicating the rapidly strengthening profile of the Indian market.

Speaking about the addition of a dedicated Houseware section this year at the trade show, the organisers’ spokesperson said, “We are delighted with the positive response we receive each year from the visitors which motivates us to provide the best possible visitor experience with innovative solutions. To cater to the changing and increasing needs of the retailers, brands, manufacturers & importers and looking at the growing demand of the houseware segment in the Indian market, we have decided to have a dedicated hall for the houseware & gifts sector that will help trade and institutional buyers understand the innovative range of products in a more focused manner, while also saving their time. We are happy to see the response of the people.”

Houseware: Urban products and brands preferences increasing

From the traditional to the modern society, across the globe, houseware has always existed as a major product category in the marketplace. Due to high degree of urbanization, proliferation of nuclear families and technological advancement, there have been far-reaching changes in the nature of houseware products. In India, globalization has also brought about significant changes in cooking, serving and dining habits. India is also witness to a major shift in buyer or consumer base for houseware products. It is no more restricted to women.

For young working couples in the urban setting, there have been wide ranging changes in lifestyle, in their socializing and food habits. Factors like healthy cooking, convenience, safety, functionality, time-saving devices and cookware are now driving the purchase decision. Complexity of the products also makes it necessary that husband-wife both engage in the purchase of these products – be it kitchenware, cookware, tableware, kitchen appliances, storage, cleaning or maintenance products, outdoor houseware, or travel goods, one can see the drastic change in market scenario. Most of the modern day houseware products are now made by combining materials like steel, plastics, ceramics, glass and so on. Hence the market classification is now less material-driven and more utility or functionality-driven.

Indian Kitchenware industry

Over the last few years, organised retail or large scale retail has been witnessing tremendous impetus in India. The growth story is expected to continue in the future. Till about 5 years back, kitchenware retail hardly received a standalone mention as a major retail category but now things are different. More than just satisfying the functional needs of the Indian consumer, modern retail in this sector is emerging to cater to the diverse needs of the customer – be it on consideration of convenience, fashion or price.

Evolution of Kitchenware Retailing

Till the early eighties, kitchenware in the average Indian home would constitute primarily copper, aluminium and stainless steel utensils; cutleries in the form of tea-cups, saucers and spoons; cookware of aluminium; plastic bottles to store spices, sugar, salt and edible oil. The only sophisticated gadgetry was perhaps the pressure-cooker. Gradual changes were seen with stainless steel utensils replacing copper and aluminium. The microwave made a grand entry in a number of kitchens in mid-90s, and then newer utensils and storage vessels started forming a vital part of the Indian kitchen.

Indian kitchens and kitchenware are now evolving from being purely functional to convenient and fashion-driven. It is the gradual shift in lifestyle that is bringing about changes in the cooking and eating habits of the Indian consumer. Convenience is emerging as an important factor for selecting kitchenware and now there is more emphasis on aesthetics, novelty and style. There were also certain manufacturer-driven factors that drove this growth, led by brands like TTK Prestige.

Market Segments

Kitchen utensils like pots and frying pans, woks, saucepans, pressure cookers and glass items such as heat-resistant casseroles and vitro-ceramic pans also form part of the products found in the cookware sub-segment. A third group of items such as plates, bowls, serving dishes, dinner sets, serving ware placemats and coasters form the tableware and crockery market sub-segment. Then there are cutlery items (like cutting tools and instruments, knives forks and spoons, etc.) and glassware items (like tumblers, stemware, bottles, jugs).

Global Sources classifies Indian houseware suppliers into four categories – household supplies, kitchenware, pet supplies and tableware. Kitchenware, in turn, is segmented further into bakeware & cookware, kitchen accessories and kitchen storage. The Keynote Market Insight report for the UK market considers cookware, utensils, ovenware and cleaning & storage as the four components of the kitchenware market. It also recognises that there could be an overlap between ovenware and cookware. In terms of material again, the market can be classified in several ways with ceramic, china and porcelain, metalware, plasticware and woodware being the major sub-segments. As is evident, there is a considerable overlap between these different product sub-segments. The cookware segment dominates the Indian houseware market.

Major Players

In India, more than 90% of sales in the segment happen through traditional channels but now modern retail, direct sellers like Tupperware and also online retailers are fast increasing their market share. In terms of manufacturers, the national players include TTK Prestige, LaOpala, Milton Plastics, Duraware, Hawkins, Anjali, and so on. While each of them is strong in certain product categories, there is no single player catering to all of the houseware categories. In the modern retail sector, general merchandisers and, to an extent, department stores have been retailing kitchenware products. Shoppers’ Stop focusses on this segment through its ‘Home Stop’ store, the Future Group through its ‘Home Town’ formats and Reliance Retail through its ‘Reliance Living’ format. Along with the entire range of home needs including furniture, soft furnishings, lighting accessories, heath equipment, etc, they also retail in kitchen appliances, kitchenware and crockery. Besides, there are certain niche players like Magpie India, which retails a whole range of tableware products – some of which may also qualify as kitchenware products – through its own retail chain or shop-in-shops in association with Shoppers’ Stop, Lifestyle, etc. In addition, there are players like Glen Appliances that manufacture and retail a range of cooking range, cook tops, built-in ovens and other related products.

Future Trends in Kitchenware Retailing

Kitchenware market in India is still very much driven by purely functional requirements and there is a huge scope for market expansion. It is a very niche market today and features mostly imported brands. The future trends are likely to remain focussed around products and retail formats. In terms of product range, non-stick cookware, healthy eating, wider range of cutlery and storage containers are some of the areas where we should see interesting developments in the near future. On the health concerns, there is an increasing growth seen in utensils that can be used to cook food without the use of oil. As for adding convenience in the kitchen, demand for cutlery products like potato peelers, garlic presses, pizza cutters, small kitchen knives, paring knife, palette knife would be some of the products that are expected to see a growing demand in the future. The fact that for effective storage of different food items, a special set of containers is required is again a trend, which is just being explored in India.

In terms of retail formats, Large Format food & general merchandise retailers will continue to deal in kitchenware products and more like Reliance Living Homeware, Home Town or Home Stop will emerge. There will also be more specialised stores dealing in kitchenware products; these can be in the form of large format ‘category-killers’ or an upmarket small size store which deals in certain categories of kitchenware. TTK Prestige Kitchen is an ideal example of this format. The future for kitchenware retailing holds immense potential, and one can expect tremendous growth in this segment in the years to come.