रिटेल

Online retail sales in India seen growing to $32.7 billion this year

(Mint) – | Fri, Jun 08 2018. 04 22 AM IST

E-commerce in India has more than tripled since 2015, but it is only expected to contribute to 2.9% of the total retail sales in 2018, says an eMarketer report

E-commerce in India is expected to grow by 31% this year to touch $32.70 billion, led by Flipkart, Amazon India and Paytm Mall. Photo: iStock

Bengaluru: Online retail sales in India are expected to grow by 31% this year to touch $32.70 billion, led by e-commerce players Flipkart, Amazon India and Paytm Mall, according to a report by marketing research firm eMarketer. However, India’s growth rate in e-commerce is yet to catch up with countries such as China and Indonesia in the Asia Pacific market.

Flipkart, Amazon and Paytm Mall have been expanding into new sectors, including grocery, and with Walmart’s recent $16 billion acquisition of Flipkart, e-commerce in India is expected to launch more offline retail stores with private labels playing a larger role in segments such as fashion and electronic accessories.

eMarketer estimates that a quarter of India’s population will become digital shoppers by end of 2018, the figure touching 41.6% by 2022.

However, E-commerce in India is yet to get into its stride. The online retail market in India has more than tripled since 2015, but it is only expected to contribute to 2.9% of the total retail sales in 2018. This, however, is expected to change in the coming years. By 2022, the sector will be worth $71.94 billion, which is a 120% growth compared to $32.70 billion in 2018, the research firm added.

Comparatively, in China, online retail already makes up more than 16% of the overall retail market, and is expected to touch 25% in 2020, according to a 2017 report by Goldman Sachs. In China, the next set of growth is expected to come from advanced logistics infrastructure and the offline-online retail mix led by omni-commerce retailers. In India, last-mile logistics still remains a bottleneck for most e-commerce marketplaces. But several companies such as Lenskart, Urban Ladder and Fab Alley have set-up brick-and-mortar stores across India to grow their customer base.

Apart from this, big offline retail chains like Max Fashion and Future Group are already experimenting with omni-commerce models.

“E-commerce is booming in India thanks to increased internet users and cheaper smartphones,” said Eric Haggstrom, forecasting analyst at eMarketer.

“In tandem with this shift to online and mobile usage, Flipkart, Amazon and Paytm Mall have been competing fiercely to claim their share of the Indian market. All three are making large investments, which include improved logistics and payment systems, as well as offering deep discounts, which will fuel future growth in the market,” he added.

Online retail sector has a threat from physical retail models: Kishore Biyani

By Indiaretailing Bureau – | November 28, 2017

Future Group CEO Kishore Biyani said the much-believed burgeoning online retail sector in India has a threat from physical retail models like Big Bazaar and Easyday, owing to low business share and high cost of business of the former.

Future Group CEO Kishore Biyani said the much-believed burgeoning online retail sector in India has a threat from physical retail models like Big Bazaar and Easyday, owing to low business share and high cost of business of the former.

According to a PTI report: The retail champion said although the next trend is digitisation, but physical and digital are not different as layering of technology over physical is the need of the hour.

“Online retail has a threat from us and it’s time people realised that they are not a threat to us, as they don’t even have 1 per cent business share and the cost of doing business is also too high,” Biyani told PTI.

Over the years, part of the retail consumers have moved to online platform such as Flipkartand Amazon for purchase of the daily use items.

“If you look world over, Alibaba is only buying physical retail, so is Amazon and therefore times have changed,” Biyani was quoted by PTI as saying adding that the fever of online shopping of consumer items by Indians have gone away.

The leading retail chain is on an aggressive expansion mode witnessing huge demand and had recently announced opening 10,000 member-only Easyday stores to make it a Rs 1.5-trillion business opportunity by 2022.

The group unveiled a 30-year vision, Retail 3.0, by when it plans to become Asia’s largest integrated consumer retailer by 2047 with revenue of in excess of US $1 trillion.

Biyani said the fashion and food categories are seeing continuous demand with the fashion segment growing rapidly and chains such as FBB, Central and Brand Factory are in good shape.

When asked about his views on online retail taking over physical retail, Biyani said both are converging and ten years from now everything will converge completely and the company has always been at the forefront, not missing any trend.

“China which people think is the most digital driven country has 82 per cent physical, America has 89 per cent physical model and similarly India too has huge potential for physical retail as online share is very less,” Biyani was quoted by PTI as saying.

“We are called Future group because we look at the future and plan much before,” he further told PTI.

As per a joint report by Ficci and Deloitte, increasing use of smartphones, apps, web and social media will lead to growth of omni-channel retail by amalgamation of offline and online services with Indian retail industry which is growing at 10 per cent, may almost double to Rs 85 trillion (lakh crore) by 2021.

Another report by Ficci and PwC last year said the consumer spending will rise backed by robust economic growth and rising household incomes.

IKEA opens first ‘Hej HOME’ in India at Hyderabad

Designed for a six month duration, IKEA Hej HOME will familiarise customers with IKEA home furnishing solutions and offer a first-hand experience of an IKEA store. PTI | November 22, 2017, 18:00 IST

Swedish home furnishing major IKEA today launched its first experiential centre ‘IKEA Hej HOME’ here, ahead of opening its first store in the country at Hyderabad in spring 2018.

Swedish home furnishing major IKEA today launched its first experiential centre ‘IKEA Hej HOME’ here, ahead of opening its first store in the country at Hyderabad in spring 2018.

Designed for a six month duration, IKEA Hej HOME will familiarise customers with IKEA home furnishing solutions and offer a first-hand experience of an IKEA store.

Hej HOME is an exhibition of IKEA products and solutions where future potential customers can experience IKEA products before they can actually buy it from its store (in Hyderabad) in spring 2018.

“The first store will open in Hyderabad in spring 2018. We have ambitious plans and decided to open 25 stores by 2025. Its a very holistic expansion plan,” said Patrik Antoni, deputy country manager of IKEA India.

After the Hyderabad store, the second store will open in Mumbai during 2019, followed by Bengaluru and Delhi NCR.

IKEA plans to bring Hej HOME to the other cities where it will open stores.

“IKEA Hej HOME is a concept exhibition where we showcase our well designed products, inspiring solutions and get many people ready to connect with the brand IKEA in a meaningful way,” Ulf Smedberg, Country Marketing Manager, IKEA India said.

It also showcases the IKEA food offer and room settings based on its learnings of ‘Life at Home’ in Hyderabadi families, especially those living with children. The display includes the bedroom, living area, kitchen and dining, play area among others.

IKEA India Sales Manager Christian Kampe said “almost 1,000 products (at the upcoming store in Hyderabad) will be priced below Rs 200”.

“In India, IKEA currently has 50 suppliers with 45,000 direct employees and going forward we are looking at expanding this supply chain,” added Patrik.

Over 50 global retailers to enter India in 6 months, likely to open about 3,000 stores

ET Bureau | Jun 19, 2017, 06.12 AM IST

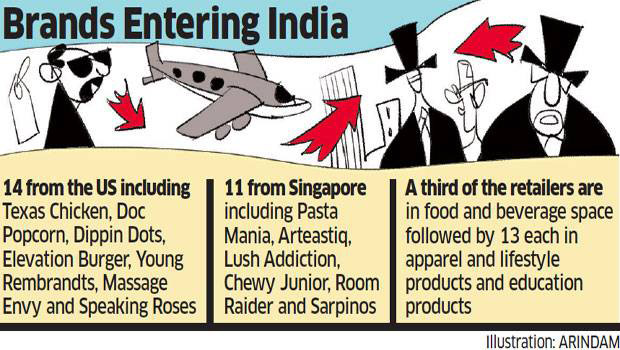

NEW DELHI: More than 50 mid-rung global retailers are planning to enter India within the next six months, according to data compiled by Franchise India that has tied up with them for their launches, with their eye mostly on smaller, untapped markets within the country.

NEW DELHI: More than 50 mid-rung global retailers are planning to enter India within the next six months, according to data compiled by Franchise India that has tied up with them for their launches, with their eye mostly on smaller, untapped markets within the country.

Brands such as Korres, Migato, Evisu, Wallstreet English, Pasta Mania, Lush Addiction, Melting Pot, Yogurt Lab and Monnalisa, many from the US and Singapore, will invest about $300-500 million — all told to open roughly 3,000 stores, triggered by the country’s expanding economy, booming consumption, urbanising population and growing middle class.

“The first retail wave happened a decade ago when bigger retailers and brands entered India,” said Gaurav Marya, chairman of Franchise India Holdings, a retail solutions provider that is helping these 53 brands find partners and get regulatory clearances. “Now, it’s the turn of small and mid-sized brands as they look to cash in on the open retail policy and huge gap in the market for branded products.” Of the incoming brands, 18 are in food and beverage space followed by 13 each in apparel and lifestyle products and education products.

Earlier this month, India replaced China as the most promising retail market in the world, according to an AT Kearney report.

As retailers struggle in their home markets, India could be the next bright spot for the industry, especially since the government has allowed 100% foreign ownership in businessto-business (B2B) ecommerce businesses and for retailers that sell food products manufactured in India.

As retailers struggle in their home markets, India could be the next bright spot for the industry, especially since the government has allowed 100% foreign ownership in businessto-business (B2B) ecommerce businesses and for retailers that sell food products manufactured in India.

“Government efforts to boost cashless payments and reform indirect taxation with a nationwide goods and services tax are also expected to accelerate adoption of modern retail,” the AT Kearney report added.

Relaxed FDI Rules

GST, one of India’s most significant tax reforms in decades, is set to be rolled out on July 1.

“India’s current growth and development make it an ideal target for the brand. Chicken products are the major non-vegetable food in the country, making our menu ideally suited to the market,” said Andrew Withers, chairman of Southern Fried Chicken, a British quick service restaurant that runs 700 franchise stores globally.

The government relaxed the rules for foreign direct investment (FDI) in single-brand retail last year, spurring interest on the part of several brands, including Sweden-based Hennes & Mauritz (H&M) and Ikea, Japan’s Uniqlo, American retailer GAP and Massimo Dutti. H&M has already opened stores in India.

However, the latest brands are mostly smaller ones that rely on the franchise system for global expansion.

Also, unlike most large global retailers which focus on urban cities initially, these smaller ones wants to cash in on smaller and untapped markets.

“India is a fast-growing market, huge in size, but Monnalisa’s target is concentrated in Tier 2 and 3 cities, allowing us to more easily reach our final users,” said Thomas Bessi, overseas sales manager, Monnalisa SpA, a European children’s wear retailer. “After the recent expansions in Brazil, Russia and China, and the saturation of the traditional markets in Europe and the Middle East, India was the last big territory that we needed to conquer.”

Opportunity in global food chains

The Indian retail market was worth $641 billion in 2016 and is expected to reach $1.6 trillion by 2026, growing at a compounded annual growth rate of 10%, according to the India Business of Fashion 2017 report. With food and grocery retail just 3% of the overall market, several global food chains sense an opportunity. The 18 QSRs, mostly snacking and ice-cream brands, will enter a market still dominated by Domino’s Pizza and McDonald’s, although the segment hasn’t been doing all that well of late.

“The snack segment in India has been showing some interesting potential as well as India’s economic development as it pertains to many different types of international franchises entering the market and culture to some degree,” said Martin Azambuya, managing director of US-based Doc Popcorn.

India overtakes China as the most promising market for retail expansion

Monday, 5 Jun 2017 | 1:37 PM ETM

- China fell out of the No. 1 spot in a ranking of the most promising markets for retail expansion.

- China’s retail market is maturing and GDP growth has lagged, but the country’s size and e-commerce opportunity remain strong, A.T. Kearney said.

- India took the top spot, helped by its expanding economy, booming consumption rates, urbanizing population and growing middle class.

As retailers struggle in the U.S., a new report suggests India could be the next bright spot for the industry.

A.T. Kearney’s annual look at emerging retail markets puts the country at the top of the list, ahead of China, which has been a longtime index leader. The report gauges the best opportunities for retail investments globally and ranks the top 30 developing countries based on the firm’s findings for market attractiveness. Population, GDP per capita, national retail sales and country risk are a few factors taken into consideration.

“The 2017 [global retail development index] is all about the geopolitical scene and how it affects business,” said Hana Ben-Shabat, a co-author of A.T. Kearney study. “Retailers are thinking twice about expansion into places where there is uncertainty about future government actions or high political risk.”

Further, “mobile shopping is challenging the ways retailers think about global expansion, as well as about their role in the value chain,” co-author Mike Moriarty added. “We are expecting more retailers to use mobile as part of their future expansion plans.”

In this year’s “Age of Focus” report, Asia houses five of the top 10 countries, including India and now second-place China.

India’s expanding economy, coupled with booming consumption rates, urbanizing population and growing middle class, are what moved the country to the top spot, A.T. Kearney explained.

Retailers such as Armani Exchange, Kate Spade, Cole Haan and Muji all entered the Indian market in 2016.

Meanwhile, China fell on 2017’s list as its market is maturing and GDP growth has lagged, but the country’s size and e-commerce opportunity remain strong, the consulting firm went on.

Top 5 countries for global retail development

Vietnam was number six on the list, moving ahead five spots from last year as the country boasts more liberal investment laws. Also in Asia, Malaysia and Indonesia placed third and eighth place, respectively, the report said.

Malaysia’s market will grow 23 percent annually through 2021, driven by its investments in electronics and media, A.T. Kearney has forecast.

Asia is the “driving force” behind global retail expansion this year, the retail report’s authors wrote. There have been notable expansions there in food and beverage, personal care products, apparel, fashion and luxury, they said.

“One might wonder why some other countries aren’t on [this year’s] index,” Ben-Shabat told CNBC in an interview.

The reason is simply high political risk.

“For an American retailer making the decision to go into a country, you want to know you’re operating safely,” she went on. “At least in the beginning, you’re sending your own people, employing local people. … Political stability of the country is key.”

Other areas worth noting mentioned in this year’s report: North Africa is making gains, and South America’s Andes markets are impressing investors, but Russia is facing more sluggish growth.

“Russia is still recovering from a recession, but there are some positive signs, including a luxury market boosted by Chinese tourists,” Ben-Shabat wrote. The country checked in at number 22 on this year’s list, unchanged from 2016.

In addition to ranking the countries that pose the best opportunities for retail investing, A.T. Kearney has predicted what will be a driver in sales over the next decade: mobile shopping. And especially in these emerging markets.

Annual spending and investments on mobile shopping in a survey of 10 large emerging markets are estimated to be $275 billion, the consulting firm found. In fact, Ben-Shabat and her co-author believe emerging markets are ahead of developed markets in terms of mobile shopping growth rates.

and students to Pune is also causing rapid changes in the buying patterns. Today the merchandise in stores reflect multi-cultural, multi-ethnic influences.” Introduction of catalogue system makes it easier for the consumers to see multiple designs and keep up with the market trends.

Mobile shopping revenue growth

Snapdeal in India, Flipkart, Alipay and WeChat are examples of companies capitalizing on mobile trends.

Changing Retail Scenario in Pune

Over the last one decade, Pune, one of the fastest growing Indian cities, just 160 Km. Away from Mumbai is also now coming up as a lucrative retail market. With entry of several national and international apparel, cosmetic and home furnishing brands and organized retailers, Pune’s retail landscape is changing by the month.

Over the last one decade, Pune, one of the fastest growing Indian cities, just 160 Km. Away from Mumbai is also now coming up as a lucrative retail market. With entry of several national and international apparel, cosmetic and home furnishing brands and organized retailers, Pune’s retail landscape is changing by the month.

As brands and sellers look for new high growth markets in India beyond metros like Delhi, Mumbai, Bangalore, Kolkata, Hyderabad and Ahmedabad; Pune, leads the race with its population of over 6 million people.

Home Fashion magazine recently interacted with some leading retailers to assess current and upcoming retail scenario in home category. What emerged is a dynamic retail environment, where consumer profile, their buying behaviour, product mix and preferences are changing rapidly. With the city increasingly acquiring a cosmopolitan and international character, year after year, Pune is becoming an ideal city for test marketing new products for their success at the national level.

Today’s Pune consumers are far more aware of product innovations, new fabrics, latest styles, designs and fashion trends. This reflects in their buying pattern which is increasingly moving towards more specific products, convenience and luxury. With several upcoming brands, consumers have more choices. And with their growing disposable incomes, frequency of purchases too is increasing.

Today’s Pune consumers are far more aware of product innovations, new fabrics, latest styles, designs and fashion trends. This reflects in their buying pattern which is increasingly moving towards more specific products, convenience and luxury. With several upcoming brands, consumers have more choices. And with their growing disposable incomes, frequency of purchases too is increasing.

Commenting on changing demand of Pune consumers and how the retailers have been adjusting to the situation, Nirav Shah of Indo Foreign Stores, a leading furnishing fabrics store which started in 1962, said, “Manufacturers understand the changing profile of Pune’s demand and supply merchandise accordingly. Earlier, the products were very monotonous, but today several upcoming products and brands offer innovative ideas. Pune consumers are adapting to this change, which reflects in changing demand pattern.” He added, “Increasing migration of multi-ethnic professionals

Ishanya, a concept destination mall in Pune with retail space of 2,25,000 sq. feet for home décor, interiors, houseware & soft furnishings, was launched in 2007 with an incredible fusion of apparels, footwear, home and accessories. The mall aimed to offer the experience of a featured mall back to back with innovations in terms of categories and entertainment. Since then, the mall has been reinventing itself by making several navigational changes, in order to stay relevant and popular.

Ishanya, a concept destination mall in Pune with retail space of 2,25,000 sq. feet for home décor, interiors, houseware & soft furnishings, was launched in 2007 with an incredible fusion of apparels, footwear, home and accessories. The mall aimed to offer the experience of a featured mall back to back with innovations in terms of categories and entertainment. Since then, the mall has been reinventing itself by making several navigational changes, in order to stay relevant and popular.

Apparel, footwear and accessories did not take the mall any further as its roots stood in home category, according to Mr. M. Mahesh, CEO, Ishanya Mall. As it stands today, Ishanya offers a total shopping experience for home products The curators behind Ishanya decided to concentrate on home products and offer a complete experience for interior designing and a one-stop home shopping to the consumers. They wanted to make it a destination mall for consumers, interior designers and institutional buyers not only from Pune, but also from neighbouring towns.

However, with Pune’s limited market potential in home category at that time, Ishanya did not take off as planned. Footfalls were fewer than expected. Customers sought more leisure activities to support shopping experience.

To overcome these limitations, last year Ishanya introduced a 100,000 sq. feet entertainment zone along with food zones, restaurants and pubs like Pubtown and Blue Frog. With presence of big home retailers like Home Town and @home as anchors and brands like Maspar, F&F, Ishanya has a potential to grow into a concept mall for home.

Since these innovation, a 20% increase in footfalls has been achieved, bringing a positive turn for Ishanya. To give a further boost, the mall has started hosting events like Pune Fashion Week and other musical events, bringing more lifestyle experiences to customers.

Latest and a big initiative by Ishanya is The HomeSukh, a smart marketplace for home décor and interiors, launched in August this year. ISHANYA will now also offer a range of cuisines for the food enthusiasts.

From being a home shopping centre, today Ishanya has evolved into an experience centre, where consumers across demographics can find a unique spot for themselves. Now surrounded by couple of other malls, Ishanya can be a good retail point for home textiles, home décor and houseware products.

Ishanya, the destination home products mall in Pune had launched Houselife, a 25,000 sq. feet new building as its furniture section, showcasing an innovative range of living room, bedroom, kitchen, kids, dining furniture and decorative accessories from over 50 brands. The section offered both readymade and customised furniture for homes.

Ishanya, the destination home products mall in Pune had launched Houselife, a 25,000 sq. feet new building as its furniture section, showcasing an innovative range of living room, bedroom, kitchen, kids, dining furniture and decorative accessories from over 50 brands. The section offered both readymade and customised furniture for homes.

On Ishanya’s 8th anniversary, Houselife has launched a brand new concept, The HomeSukh, targeting impulse shoppers. On lines of the concept of the Arabic souks, The HomeSukh is spread on 20,000 sq. feet over two levels. Formatted on lines of an exhibition, HomeSukh offers over 10,000 products directly from manufacturers across the country, making it a complete solution provider for home décor and gifts.

“The HomeSukh” focusses on consumers seeking innovations in home décor. About 30 brands of home décor items, curios, carpets to rugs, wall art, figurines to décor lighting, bags to souvenirs and gifting accessories are showcased here to satisfy ever-evolving interior styling needs. For the first time, manufacturers and artisans have been brought under one roof on such a large scale.

The HomeSukh design is inspired by the concept of Verandah, lending an open air ambience laced with warm inviting colours, unwinding the experience of strolling on the streets and relaxing in a garden atmosphere. The overarching of The HomeSukh is enthused by nature, depicting simple direct tones, abundance and ideas to embellish homes and enrich lifestyles.

Speaking on the occasion, Mahesh M, CEO, Ishanya, said, “The HomeSukh is not just another brand; it is a concept which brings to life the adage of little things which create Big Joys! It is a one stop destination to address a homemaker’s desire of keeping her home vibrant, lively and adaptable for different reasons and occasions. We are excited to live up to our vision, which is “to look at Joy of creation”, of revolutionizing the concept of destination shopping and experiencing retail. With rising incomes, increasing purchasing power, brand consciousness, evolving consumer preferences and growing urbanization, we believe that we have tremendous potential in Pune”. How this vision translates into business, only time will tell.

and students to Pune is also causing rapid changes in the buying patterns. Today the merchandise in stores reflect multi-cultural, multi-ethnic influences.” Introduction of catalogue system makes it easier for the consumers to see multiple designs and keep up with the market trends.

– Neeraj Kukreja, owner, Kukreja Handlooms & Furnishings

Neeraj Kukreja, owner, Kukreja Handlooms & Furnishings, which stocks leading Indian brands too feels Pune’s market is changing, but for different reasons. He said, “Today consumers are adapting lifestyle and products from Television Soap operas and no longer want to relate to the conventional era. They expect innovations across products and brands. Driven by consumers’ need for change, style of interiors is also changing.

7-8 years back curtains were considered a luxury product, but now they have become

a necessity product. Television has also influenced incremental purchase of home décor products. Besides Television, growth of multi-cultural population due to increasing number of MNCs, too is making Pune more diversified and growth oriented.” he said, adding, “basic bed linen were in demand earlier, but now the trend is in favour of crafted and embroidered ones. Spending by newly married couples is increasing. If both husband and wife are working, they tend to spend even more on furnishing their new house.”

A common view expressed by both these retailers is that with increased numbers of students and young professionals in Pune, youth buying has increased. They are inclined towards budget purchasing as most live in rented houses for short term. Besides, youngsters prefer buying expensive gadgets over expensive home furnishings or décor. Innovations in the former attract them more. They are also more inclined towards online shopping, they find it more convenient and practical.

Mahesh M, CEO, Ishanya mall, adds another angle to Pune youth’s buying behavior. Commenting on the same, he said, “Pune being a smaller cousin of Bengaluru in terms of weather, IT culture and night life; young crowd here tends to opt for good things and good experiences in shopping, lifestyle or decorating their house- be it permanent or temporary. Sales today depend on younger family members who want to buy anything which is trending. Their choices can be as wide as figurines to photo frames to carpets to cushions! Differentiated designs and uniqueness in a product attracts them into buying.

Mahesh M, CEO, Ishanya mall, adds another angle to Pune youth’s buying behavior. Commenting on the same, he said, “Pune being a smaller cousin of Bengaluru in terms of weather, IT culture and night life; young crowd here tends to opt for good things and good experiences in shopping, lifestyle or decorating their house- be it permanent or temporary. Sales today depend on younger family members who want to buy anything which is trending. Their choices can be as wide as figurines to photo frames to carpets to cushions! Differentiated designs and uniqueness in a product attracts them into buying.

Bold prints, printed letters, digital prints on cushion covers are current trends which are popular with these consumers- for both fashion and home. On décor front, vintage cars and gliders inspire the Pune youth currently.”

Overall, Pune’s retail scenario is becoming more discrete. But demand continues to grow across consumer segments and product categories. Pushed by competition and changing consumer expectations; retailers, brands and manufacturers introduce new products at greater frequency than before. Despite rapid change in market scenario, most players are positive about the future of their business in this city.

Indians overall tend to shop at least price and within budgets. Pune is no different. Retailers must consider these factors in their long-term business planning.

Jagdish Stores launched in Ludhiana

Jagdish Stores, Delhi, the pioneer, oldest and one of the most respected retailer for home furnishings in India, opened its fourth store and the very first in Ludhiana 9th August 2015. The retailer has well-known stores in Delhi and Kolkata.

Jagdish Stores, Delhi, the pioneer, oldest and one of the most respected retailer for home furnishings in India, opened its fourth store and the very first in Ludhiana 9th August 2015. The retailer has well-known stores in Delhi and Kolkata.

Spread over a huge area of 25,000 square feet on 5 floors, one of the largest in India till date for a single specialty home furnishing retailer, the store was inaugurated by Mrs. Derrco Devi Khandelwal,mother of Mr. Jagdish Khandelwal, Managing Director, Jagdish Stores, who himself is known in the industry as the father of Indian furnishing retail.For him personally and for the entire family, this was a highly emotional moment. The high profile launch was attended by who is who of not only Ludhiana city, but the entire home textiles and furnishing industry and trade from across the country, reflecting the personal popularity of Mr. Jagdish Khandelwal in the industry.

The exclusive boutique-store will stock the same quality and range of home textile & home décor products as the other branches do. These include fabrics, upholstery, curtains, carpets, mattresses, bed linen, table linen, bath linen and decorative accessories. Hence, the store will give an opportunity to the people in Ludhiana and surrounding cities and towns to shop for high quality and unique merchandise with a high standard of customer service for which the retail brand Jagdish Store is known for over five decades.

The exclusive boutique-store will stock the same quality and range of home textile & home décor products as the other branches do. These include fabrics, upholstery, curtains, carpets, mattresses, bed linen, table linen, bath linen and decorative accessories. Hence, the store will give an opportunity to the people in Ludhiana and surrounding cities and towns to shop for high quality and unique merchandise with a high standard of customer service for which the retail brand Jagdish Store is known for over five decades.

Commenting on the establishment of the new store, Mr. Jagdish Khandelwal, MD, Jagdish Stores, said “Ludhiana is one of north India’s most prosperous cities with an elite class of citizens. We already have a loyal clientele of Ludhiana who patronize our Delhi store for their home furnishing needs. We are delighted that with the opening of this boutique, these patrons, and new ones, will not have to travel all the way to our other outlets to enjoy high quality furnishings, which have an Indian soul and an international appeal. We’re looking forward to a long and meaningful association with the city, and to servicing its people at a standard that is synonymous with our brand.”

Specialty format stores will always be important and convenient for the customers as it gives the customers an experience factor of feel & touch.Jagdish Stores, Ludhiana also has a team of trained interior designers and home stylist to customize the products according to the choice of the customers.

Specialty format stores will always be important and convenient for the customers as it gives the customers an experience factor of feel & touch.Jagdish Stores, Ludhiana also has a team of trained interior designers and home stylist to customize the products according to the choice of the customers.

Many high-profile celebrity homes, corporate offices, restaurants and boutique hotels have relied on fabrics and furnishings from Jagdish Stores to enhance their interiors. Also India’s most respected architects and interior designers have given a top choice priority to the India’s largest chain of home furnishing as well.

The brand is also a favourite with individual customers, who enjoy visiting just to survey the new collections as much as they enjoy buying and decorating with them. Opening of the store is likely to set a new retail trend in Ludhiana and Northern India.

Online or offline Retail: “All Retail Formats will Co-exist and Need to Collaborate”

Sitaram Kumar, Vice-President, Home Centre, Landmark Group

Sitaram Kumar, Vice-President, Home Centre, Landmark Group

There has been a constant debate about the threat posed by online retailers to the offline retailer by offering deep discounts on merchandise across categories- especially in core home categories like bed linen and decorative accessories.

What do leading and successful offline retailers feel about this threat or the so-called unfair competition by their online counterparts? In an exclusive interview with Home Fashion magazine, Mr. Sitaram Kumar, Vice-President, Home Centre, Landmark Group, shares his candid opinion on this issue and various other aspects of home retail market in India.

HF: How has the home products market grown and evolved over the past 2-3 years and have there been any significant changes in the past one year?

SK: The home market has been consistently growing at a CAGR (Compounded Annual Growth Rate) of 30%. Looking at the growths and potential of the category, over the last one year, more players have entered into home space, both in online and off line versions. The changes in lifestyle and buying habits of Indian consumers are making the industry more robust and attractive.

HF: It is now being widely mentioned that younger customers are turning towards stores for buying home products while older customers are finding it more convenient to buy online – Do you agree? Reasons?

HF: It is now being widely mentioned that younger customers are turning towards stores for buying home products while older customers are finding it more convenient to buy online – Do you agree? Reasons?

SK: Partly yes and partly no – there is still a large number of customers who would like to have a touch and feel of the product before they buy, irrespective of the age group. This is especially true of the big ticket items like furniture.

HF: What growth are you expecting in the home textiles and home décor product category for 2015-16?

SK: Currently, the growth is to the extent of about 25%. Depending on how the festive season and last quarter of 2015 trends, which is the bestselling quarter in India, the industry should be able to close the year with not less than 30% market growth for the current financial year.

HF: Which home products are top sellers in terms of volumes and which ones earn maximum sales in value terms? Has there been any significant change in the top selling products over the past 2 years? If yes, which specific products have seen maximum change in demand and why?

SK: Bed sheets and curtains are the top selling products in both volume and value and the trend continues….Having said that, kitchen as a category is showing good traction and growing consistently especially in the kitchen gadgets and accessories segment.

HF: In what way and to what extent are online retailers impacting offline retail business in the home product segment?

SK: There should not be any major impact on offline business as the size of the market is big enough for everyone to sustain and cater to so many different segments and needs of the evolving customers.

HF: For offline retailers, is the major competition from online retail or from other brick and mortar retail formats? Who are your major competitors? Within offline, is the main competition from large format value retailers or from home product specialty stores? Why?

SK: Competition can be from anywhere irrespective of brick and motor, LFS, speciality or online…provided one does not focus on innovation in terms of merchandise mix, proper presentation of product categories, coordinate the ranges, do right pricing, ambience and customer service etc., It is important to package all of these well, enabling one to become the market leader. It is very essential to understand consumer behaviour enabling to be closer to the customer requirements rather than living with the fear of competition etc.,

HF: E-commerce players say that home product retail is more suited to online format as this category requires vast physical space in the store to display all products. Do you agree with this view? Reasons?

SK: Every business is suitable for both online and offline depending on how the same would be operated and at the same time how much convenience the customer is looking for in the category. It is important for all the businesses to be present both online and offline as majority of the customers prefer their convenience. As I said in the previous question, there is still a customer who would not buy the product without the touch and feel especially categories like sofas. Also, online retailers live on larger width when compared to off line retailers and the cost of carrying so many options at the back end is also huge cost, which is not the case with the off line retailers. Especially in furniture online space, we have understood that 70% of the business is coming from the cash and carry in core furniture items like bedroom, living and dining as the customers need to feel it before they buy these big ticket items.

HF: What can be the justification for heavy discounting by e-commerce players, especially when it is a drain on their resources? What is the appropriate strategy to counter such competition?

SK: Offering lower prices will not be a long term strategy. During the initial stages, one can lure the customers with lower prices but it cannot be retained in the long run. E-tailers are thinking beyond discounts to acquire customers and build loyalty. Also, there is an increase in pressure from the investor firms to cut down on discounts and concentrating on making profits. The more mature firms in the business are gradually changing the strategy. Hence, it is important to have a clear strategy and vision for the brand and the product category rather than being a part of price war and diluting the brand equity, which in turn is not sustainable.

HF: Online retailers have managed to set up a robust door delivery network and the same can also be leveraged by departmental store chains and other LFS. What are your views on the same?

SK: Agree. This is one area where the online retailers have worked and initiated in setting up robust delivery mechanism when compared to off line retailers because of the modus operandi that they are into in terms of their return policies, cash and deliveries etc… Yes, it is important for LFS to learn and implement wherever the gaps are enabling to be satisfy the customer.

HF: What in your view is the percentage share of modern, traditional and online retail in the home textile and home décor categories, on an all-India basis? How do you expect it to change in the next 2 years?

SK: Modern and traditional retail together will be accounting for approximately 80% and the online sales should be about 20%. In my opinion, the changing dynamics of technology, smart phones, access to internet, convenience etc., will lead to a 60% of share in modern and traditional retail and 40% will be online sales in the next 2 years. Today majority of the customers prefer their preferred brand is available in all mediums – brick and motor store, website and mobile application.

HF: How best can online retailers and departmental store chains collaborate so as to benefit each other and also the consumers?

SK: Current challenges that home industry faces across all formats are related to infrastructure, deliveries and the supply chain problems. All these formats together need to set up a forum to collaborate, exchange ideas and views in setting up some robust processes enabling to solve the industry problems and in the process benefit the industry as a whole.

HF: What will be the likely effect of global currency volatility on Indian domestic home product retail? Can India demonstrate better resilience to this crisis than it did in 2008 and 2013 global meltdown? Why?

SK: This is the most challenging part in any import related business especially with the volatility of dollar, the prices go up by about 15-20% in the current scenario, which is unavoidable and if the macro economic situation is not good then the sales will definitely take a dip. Having said that, I don’t think that it will have an impact on India because of the currency reserves that the country has and with the sound foundations of our economic principles, should not have any issues.